Alexandra Semenova

Bloomberg

August 21, 2023

- Citi, HSBC, Goldman eying when investors should pile in

- With soft landing, it may hit reset on lofty equity valuations

If the August downturn for US stocks resumes, Wall Street strategists say it may be a buying opportunity for those who sat out of this year’s rally — not the beginning of another painful slide.

At HSBC Corp., chief multi-asset strategist Max Kettner said it’s not time to pounce just yet, with some tests still ahead, but that a continued drop would be a sign to boost exposure. Citigroup Inc.’s Scott Chronert has echoed that, should the S&P 500 Index draw back near May’s levels.

And at Goldman Sachs Group Inc., David Kostin, the chief US equity strategist, also sees more room for investors to step up their equity holdings if it continues to look like a soft landing is in store for the economy. He said hedge funds’ leverage levels suggest they have the power to boost their buying — while reduction in cash holdings at mutual funds may also signal an increase in potential demand.

“We find that US investors have room to further increase their exposure to equities,” Kostin said in a Monday note. “Should the US economy continue on its path to a soft landing, we believe the recent decrease in equity length will be short-lived.”

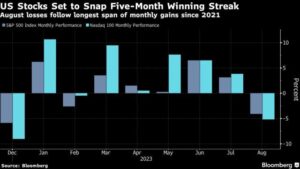

The stock market’s pullback this month ended a five-month winning streak for US equities, when prices rallied strongly on optimism that the Federal Reserve was poised to finish its aggressive rate hiking without derailing the economy’s growth. The gains were also fueled by excitement about the potentials of artificial intelligence, contributing to a surge in the prices of tech stocks like chipmaker Nvidia Corp.

There remain plenty who think stocks have room to push lower, of course, given the high uncertainty about the economy’s trajectory. Yet there have been few signs of outright bearishness in this month’s retreat, and on Monday stocks rebounded, with the Nasdaq 100 Index up over 1%.

Hedge funds and other large speculators narrowed their net-short positions in S&P 500 futures to the smallest in 14 months, according to the latest batch of Commodity Futures Trading Commission data Friday. And analysts say the drop this month may be a welcome break from the steep gains that pushed valuations to lofty levels.

Citigroup’s Chronert said late last week that a fall in the S&P 500 back to 4,200-4,300 — around where it was from late May and early June — would create an “attractive re-entry point” for long-term and tactical investors. It was trading around 4,390 on Monday afternoon.

LPL Financial’s chief technical strategist, Adam Turnquist, also deemed that range the next major area of support and a “logical spot for a rebound,” given record-high cash levels in money market funds.

Meanwhile, HSBC’s Kettner is waiting for the market to get through some crucial hurdles — particularly the Fed’s Jackson Hole symposium set to commence Thursday, which he predicts could spur another leg lower for stocks.

“But we’d use such renewed sell-offs to scale up exposure to equities further, particularly in US equities,” he said in a client note Monday.

Even if stocks face deeper losses, Leuthold Group’s chief investment officer, Doug Ramsey, said in a note that a new record high for the S&P 500 can’t be ruled out in the months ahead, given that it came close at July’s end to retracing the early 2022 peak. Such a powerful recovery from a bear market has been “a bear market killer,” he wrote.

“There are a lot of buyers who missed out on a good portion of this rally and will step in, so I don’t think there is going to be an Armageddon September, October sell-off,” said Jay Hatfield, CEO at Infrastructure Capital Management.

“You have people on the sidelines, strategists and portfolio managers, who are poised to step in if they see a pullback,” he said. “There’s a lot of dry powder.”