Alex Harring

CNBC

July 10, 2024

Needham sees Apple doubling its revenue growth by building out an advertising business.

Analyst Laura Martin said the big technology company’s single-digit revenue growth rate feels “increasingly at risk” over a three-year time horizon. Instead, she said the personal technology giant should follow fellow megacap tech titan Amazon’s lead in creating an advertising arm.

“We can’t think of another revenue stream that AAPL could pursue that is larger and more profitable than ad revs,” Martin told clients in a Wednesday note.

Martin pointed to eMarketer data showing worldwide ad revenue should come in at just about $9.3 billion for Apple in the 2024 fiscal year. That figure includes $6.3 billion from the U.S. and $3 billion abroad.

However, the firm estimates total ad spending around the globe should come in at $966 billion, with $500 billion in mobile advertising. Since both of these figures are far larger than the total revenue estimate of under $400 billion for Apple in the year, she said it is worth pursuing advertising as an income stream.

On top of this, she also noted that total global ad spending is growing at an eye-popping rate of seven to nine times as fast as Apple’s total revenue. Since ad margins are typically between 70% and 80%, Martin said it can offer a way to boost margins without requiring price hikes for Apple products.

Martin also highlighted that both Apple management and many investors agree the company is as able as Amazon in building a new business. For Amazon, the e-commerce giant was able to grow its advertising business from just $3.7 billion in revenue in 2017 to an estimated $56 billion in 2024.

If Apple takes expanding the business as seriously as Amazon did, the analyst said it can also see annual growth between 50% and 120% in the early years.

Selling connected TV ads on AppleTV+ could alone double the company’s expected revenue growth rate of just 1% this year, Martin said. More broadly, she said advertising could help “reinvigorate” Apple’s “anemic” revenue growth rate, while also accelerating free cash flow growth and upside to return on invested capital.

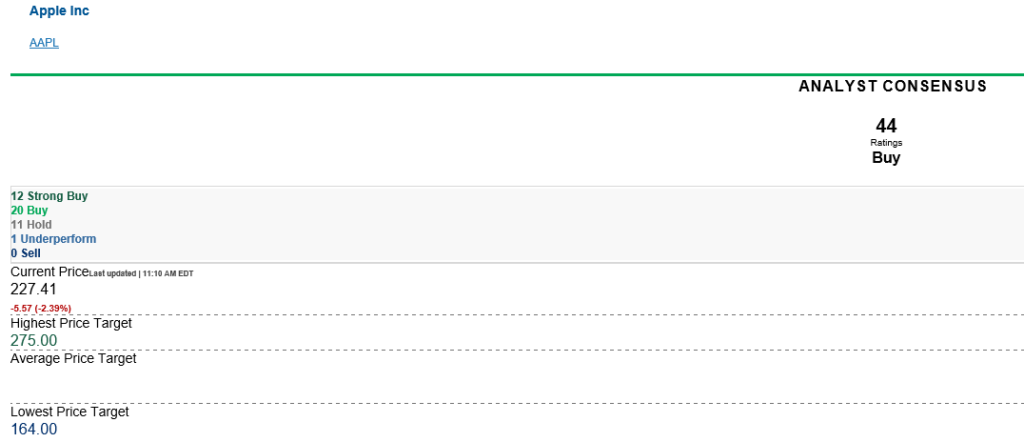

Similar to the majority of analysts polled by LSEG, Martin has a buy rating on Apple. She recently raised her price target by $40 to $260, citing its $110 billion share repurchase during a period when Big Tech peers are spending on generative artificial intelligence. That new target implies 13.7% upside from Tuesday’s closing level.

Apple shares have climbed more than 19% this year. The stock has outperformed the broad S&P 500, but has seen smaller gains than the tech-focused Nasdaq Composite.