Treasury Secretary Janet Yellen said the surge in longer-term bond yields in recent months is a reflection of a strong US economy, not the jump in government borrowing driven by a widening fiscal deficit.

“I don’t think much of that is connected” to the US budget deficit, Yellen said at an event in Bloomberg’s Washington office Thursday. “We’re seeing yields go up in most advanced countries.”

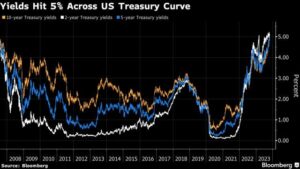

The increase in yields — which has taken benchmark Treasury rates to the highest levels since before the global financial crisis — is instead “largely a reflection of the resilience people are seeing in the economy,” she said. She spoke hours after data showed the US economy grew at an annualized rate of 4.9% in the third quarter, the fastest pace in nearly two years. Robust consumer spending was a key driver, in turn supported by a persistently strong labor market. Yellen said she wouldn’t be surprised if the US posts a growth rate of 2.5% for 2023.

“The economy is continuing to show tremendous robustness and that suggests that interest rates are likely to stay higher for longer,” she said.

Federal Reserve Chair Jerome Powell last week cited a raft of reasons why yields are going up, including the economic resilience argument that Yellen made Thursday. But he also listed a heightened focus on deficits as another possible “candidate” behind the moves, in addition to other dynamics including the Fed’s shrinking bond portfolio.

Yellen also cautioned it’s not clear that long-term yields will stay higher over the long haul. The trends that had produced low levels for yields before the pandemic are “still there,” she said.

Many bond market participants have pointed to the sharp increase in the federal deficit as being a key factor behind the increase in yields. The US government’s budget gap effectively doubled in the fiscal year that ended in September, and some recent auctions of Treasuries haven’t been well received by buyers.

Next week, the Treasury is due to update its debt-issuance plans, with strategists and investors wary about how much extra the department plans to sell of longer-term securities.

Yields dipped on Thursday despite the stronger-than-expected increase in third-quarter gross domestic product. Ten-year yields were down about 11 basis points as of 2:35 p.m. in New York, at 4.85%.

The Treasury chief said that the US is on a path toward a soft landing, with inflation coming down without a recession.