Augusta Saraiva

Bloomberg

October 17, 2023

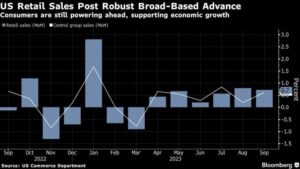

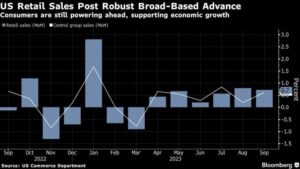

- Increase in household purchases spans variety of categories

- Data bolster already-robust economic growth in third quarter

US retail sales increased in September by more than forecast in a broad advance that suggests durable household demand as the third quarter drew to a close.

The value of retail purchases, unadjusted for inflation, increased 0.7% after an upwardly revised 0.8% gain in August, Commerce Department data showed Tuesday. Excluding gasoline, September sales advanced 0.7%.

So-called control group sales — which are used to calculate gross domestic product and exclude food services, auto dealers, building materials stores and gasoline stations — rose a better-than-expected 0.6%.

In the third quarter, control group sales rose an annualized 6.4%. Purchases rose in eight out of 13 categories last month, including stronger receipts at restaurants, motor vehicle dealers and personal care stores.

| Metric |

Actual |

Median Estimate |

| Retail sales (MoM) |

+0.7% |

+0.3% |

| Sales ex. gas, autos (MoM) |

+0.6% |

+0.1% |

| ‘Control group’ sales (MoM) |

+0.6% |

+0.1% |

The advance showcases a consumer that’s still powering ahead despite the recent energy-driven pickup in inflation. While wage growth is starting to lose steam, the labor market remains generally strong, offering Americans the leeway to keep spending.

The data bolster expectations of stronger economic growth in the third quarter.

Sustained strength in consumer demand, in the aftermath of September price data showing stubborn inflation, risks prompting Federal Reserve policymakers to raise interest rates again before the end of the year.

Treasury yields and the dollar rose following the report, while US stock futures remained lower, as traders boosted bets on another Fed rate hike