By Anna Wong (Economist), Eliza Winger (Economist) and Stuart Paul (Economist)

09/17/2025 13:30:41 [BI]

Summary by Bloomberg AI

▪ The FOMC lowered the federal funds rate target range 25 basis points to 4.0%-4.25% — as widely expected — the first cut since December.

▪ The median participant sees another 50 bps of cuts this year — 25 bps more than in the last version — and still anticipates 25 bps of cuts in each of 2026 and 2027.

▪ The median participant now sees core inflation remaining persistently higher than before — yet also sees a need for more rate cuts.

(Bloomberg Economics) — OUR TAKE: The 25-basis-point cut at the September FOMC meeting was widely anticipated. More eye-catching was the tension simmering in the updated forecasts, the policy statement, and Fed Chair Jerome Powell’s news conference.

While the median participant expects two more 25-bp cuts this year, almost half of the FOMC expects just one or no more cuts this year. The policy statement flagged growing downside employment risks — as Powell did in the news conference — yet officials marked up their 2025 growth estimate in the Summary of Economic Projections (SEP) and lowered the unemployment rate estimates over the forecast horizon. The median participant now sees core inflation remaining persistently higher than before — yet also sees a need for more rate cuts.

We see two possible explanations for this dissonance: Either the committee has adopted a more dovish reaction function — how they adjust policy tools like the federal funds rate in response to changes in economic conditions — or they’re acting as if the labor market is much weaker than the unemployment rate shows. We favor the former explanation.

- The FOMC lowered the federal funds rate target range 25 basis points to 4.0%-4.25% — as widely expected — the first cut since December. There was one dissent, by new Governor Stephen Miran, who wanted a 50-bp cut.

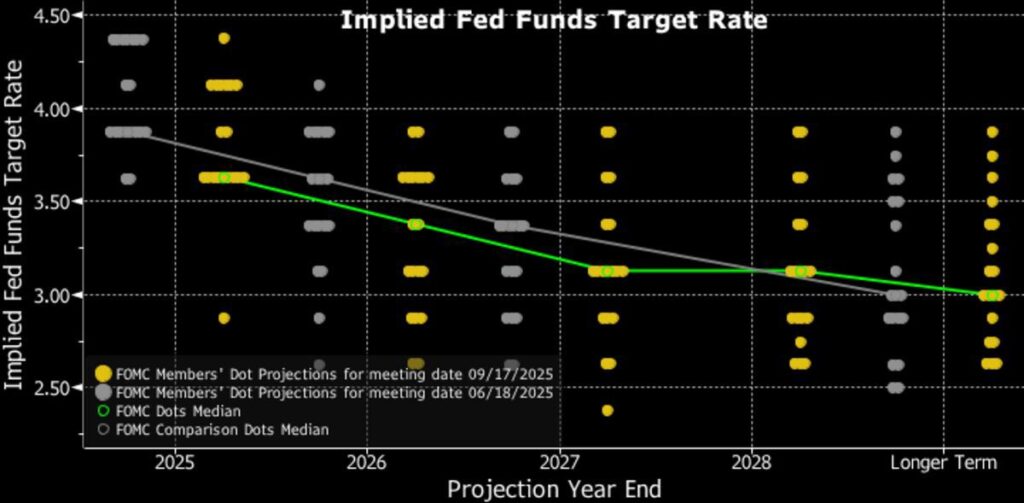

- In the updated dot plot, one participant’s dot appears to anticipate the fed funds rate will be higher at year-end than it is now. We don’t think that official anticipates a hike this year — we see that as a silent dissent in favor of holding rates constant at this meeting. We think that dot is from Cleveland Fed President Beth Hammack.

- The median participant sees another 50 bps of cuts this year — 25 bps more than in the last version — and still anticipates 25 bps of cuts in each of 2026 and 2027. But the distribution of dots show almost as many officials anticipate just one or even no additional cuts this year:

◦ One shows year-end rates 25 bps above the post-meeting target range — which we take as a silent dissent by Hammack.

◦ Six show no additional cuts in 2025.

◦ Two show one more 25-bp cut this year.

◦ Nine show 50 bps of further cuts this year.

◦ One shows an additional 125 bps of cuts in 2025.

◦ Miran, who was confirmed by Congress to replace Governor Adriana Kugler on Sept. 16 — the first day of the FOMC meeting — most likely was the one who penciled in 125 bps more cuts for 2025.

With only two more meetings to go this year, that implies he believes one of those meetings should see a 75-bp cut.

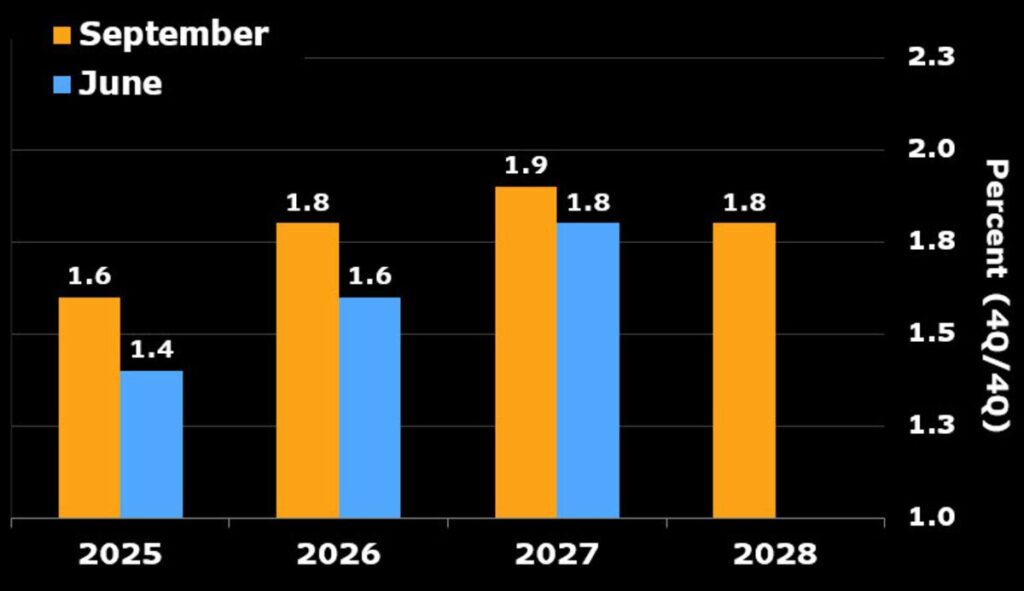

- In the Summary of Economic Projections (SEP), officials slightly upgraded this year’s GDP growth forecast to 1.6%, vs. 1.4% in the June version. After the economy grew at an average pace of 1.4% in the first half of this year, the projection implies 1.8% growth in 2H.

- Interestingly, even as the policy statement flagged growing downside risks to employment, the median participant lowered the unemployment-rate forecasts in the updated SEP to 4.4% for 2026 (vs. 4.5% prior), and 4.3% for 2027 (vs. 4.4% prior).

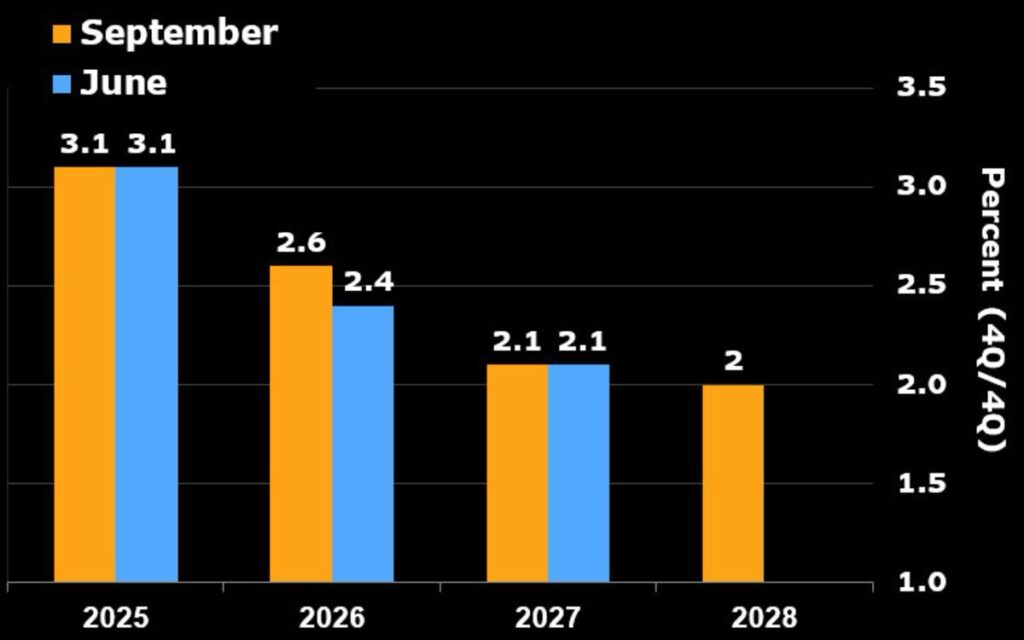

- The median participant maintained this year’s core PCE inflation forecast but raised the 2026 view to 2.6% (vs. 2.4% prior) — with the central tendency of the 2026 distribution shifting up too.

- Powell sought to explain these apparent contradictions throughout the news conference, but we think he only amplified the confusion. He justified the decision to cut rates by asserting that downside risks to employment have increased. But he also said most of the labor-market slowdown was due to a reduction in immigration, and pointed to the economy growing at 1.5% — which is “not a bad economy.” At the same time, he said, the Fed needs to “keep our eye on inflation.”

- Bottom line: The Fed delivered a 25-bp insurance cut, but the updated dot plot underscored divisions on the committee as it projected more rate cuts while upgrading growth and employment projections. For whatever reason, it appears the Fed’s reaction function has shifted in a more dovish direction.

Updated Dot Plot Shows Additional Cut This Year

Source: Federal Reserve

Key Takeaways from Powell’s News Conference

Fed Chair Jerome Powell’s performance at the post-meeting news conference can be aptly summarized by an adage from one of his predecessors, Alan Greenspan: “I know you think you understand what you thought I said, but I’m not sure you realize that what you heard is not what I meant.”

Throughout the press conference, Powell sought to justify the decision to reduce rates while also explaining why so many FOMC members saw little need to cut for the rest of the year. The justification for cutting rates at the September meeting – which Powell said the committee carried out with “unity,” despite the one open dissent – is that downside risks to employment have increased.

Contradicting that explanation, however, Powell said most of the labor-market slowdown is due to a reduction in immigration, which isn’t something monetary policy can address. The median FOMC participant also revised up the inflation forecast and boosted the growth forecasts, while revising down the expected unemployment rate – all changes that would argue against a need for more rate cuts this year. Furthermore, Powell said there was a wide and diverse range of views on the committee, with nine dots in the new the dot plot anticipating no more cuts this year, or only one cut.

In the end, Powell’s attempt to explain these conflicting views was convoluted. Perhaps the mixed message reflects the elevated uncertainty surrounding the forecasts: FOMC members themselves have only a blurry picture of what will happen.

Powell characterized September’s rates move as a “risk-management” cut, but we think the risk the committee is really fending off is the heat from President Donald Trump. Otherwise, the updated economic projections simply don’t justify the updated dot plot.

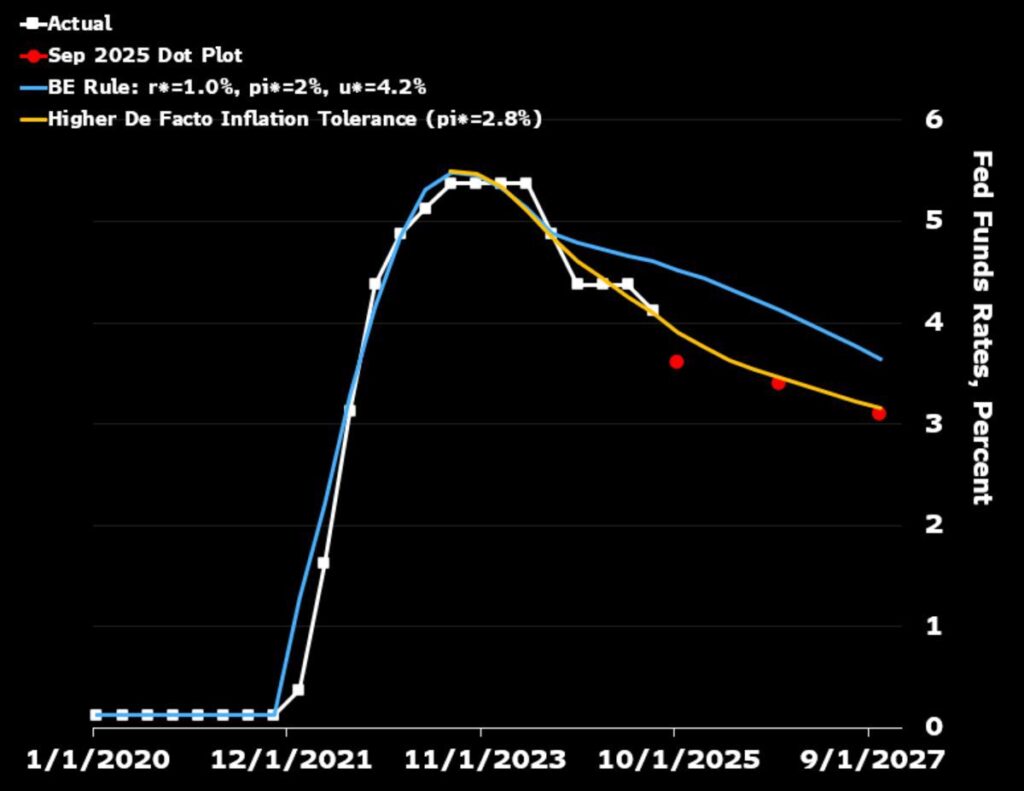

FOMC Appears to Be Targeting 2.8% Inflation Rate, Not 2.0%

Source: Bloomberg Economics

FOMC Expects Deeper 2025 Cuts, Uncertain About 2026

The median FOMC member now expects there will be a total of 75 bps rate cuts this year, up from 50 bps in the June SEP. One member — presumably Miran, the newest governor — thinks more rate cuts are appropriate this year: The lowest dot in the 2025 dot plot shows 150 bps of total cuts this year.

The committee’s forecasts beyond 2025 are full of uncertainty. The median member still expects just one 25-bp cut in each of 2026 and 2027. But the distribution of dots is wide, with risks skewed toward a faster pace of cuts in each of those years.

The new SEP also includes a forecast for 2028; the median FOMC member does not expect rate cuts will be necessary at that point, and the distribution of dots for 2028 is far more balanced.

SEP Forecasts Stronger Growth, Lower Unemployment, Elevated Inflation

The slight upward revision to GDP was not accompanied by changes to either the unemployment rate or inflation projections for this year. The median participant marked up the 2025 real GDP forecast to 1.6% (vs. 1.4% in the June SEP). But the unemployment rate projection remained at 4.5%, PCE inflation at 3.0% and core PCE inflation at 3.1%.

Economy Seen Slightly Stronger

GDP for 2026 was also revised upward to 1.8% (vs. 1.6% prior), but the unemployment rate was revised down to 4.4% (vs. 4.5% prior). PCE and core PCE inflation for next year were both revised higher to 2.6% (vs. 2.4% prior for both).

Higher For Longer Inflation

Source: Federal Reserve

For 2027, GDP was revised slightly higher to 1.9% (vs. 1.8% prior) with a slightly lower unemployment-rate forecast of 4.3% (vs. 4.4% prior), and with inflation stabilizing at 2.1%. Longer-run projections remained unchanged.

Markets Waver as Powell Explains FOMC’s Uncertain Path

Markets wavered following the interest-rate announcement and SEP release. The dollar index immediate fell 0.5%, before recovering during Fed Chair Jerome Powell’s news conference and inching higher. Two- and 10-year Treasury yields also fell immediately on the release and then rose during the news conference. An hour after the release, the two-year yield was effectively unchanged, and the 10-year was 1.7 bps higher.

The S&P 500 index chopped 0.8% lower following the release, before retracing and recovering nearly halfway through the news conference.