Thursday, May 26, 2022 09:00 AM

(Bloomberg Economics) —

Personal spending kept growing at a solid clip in April, Bloomberg Economics estimates. American consumers remained resilient to high inflation, increasingly relying on credit cards amid a record-low ratio of household debt servicing to income.

| BE Estimate | Consensus | Prior | |

| Personal Income (Apr.) | 0.6% | 0.5% | 0.5% |

| Personal Consumption | 0.9% | 0.7% | 1.1% |

| PCE Deflator | 0.1% | 0.2% | 0.9% |

| Core PCE Deflator | 0.3% | 0.3% | 0.3% |

- Total personal income is estimated to rise a robust 0.6%, matching growth in a measure of labor income derived from the jobs report. Other sources likely to advance include interest income on assets as rates rise, and a pickup in rental payments in a tight housing market.

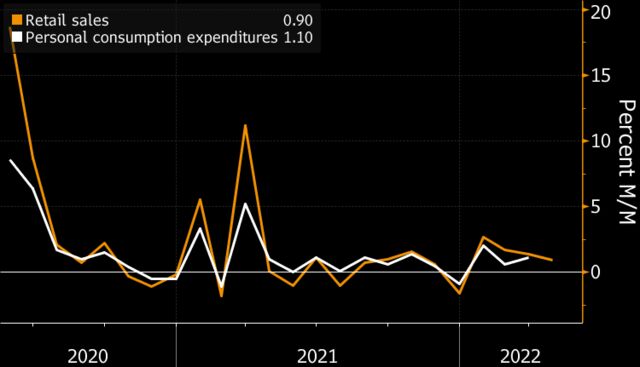

- Retail sales rose 0.9% in April, a gain that looks more impressive after two upward revisions to the March advance — to 1.4%, from 0.5% initially and 0.7% in revised data made available in late April.

- The share of discretionary items in the consumer basket has fallen sharply recently, in part because inflation forces Americans to spend more on necessities and as demand wanes for items that consumers bought a lot of during the pandemic.

- Services spending is expected to accelerate into the summer following what we estimate was a robust gain in April. Americans traveled en masse over the Easter and Passover holidays, pushing airfares sky-high in April.

- Headline PCE inflation (0.1%) will undershoot the core (0.3%) — commensurate with the mix seen in the CPI report — as lower gasoline prices subtract. The headline measure may decelerate to 6.2% year over year (vs. 6.6% prior), while the core moves down to 4.9% or slightly below, from 5.2% prior.