August 1, 202510:15 AM PDT

By Davide Barbuscia

The report comes two days after the U.S. central bank left unchanged its benchmark interest rate and avoided signaling imminent rate cuts, dialing back market expectations for an easing at the next policy meeting in September.

That changed dramatically on Friday, with odds for a 25 basis point cut in September jumping to around 81% after the data from 38% on Thursday, according to CME Group data.

“The Fed’s job is becoming increasingly difficult based on the deterioration of the economic data,” said Matthew Miskin, co-chief investment strategist at Manulife John Hancock Investments. “These revisions are massive and really are a game changer to the Fed’s reaction function, and so I think this Fed meeting is one that they’d like to revise.”

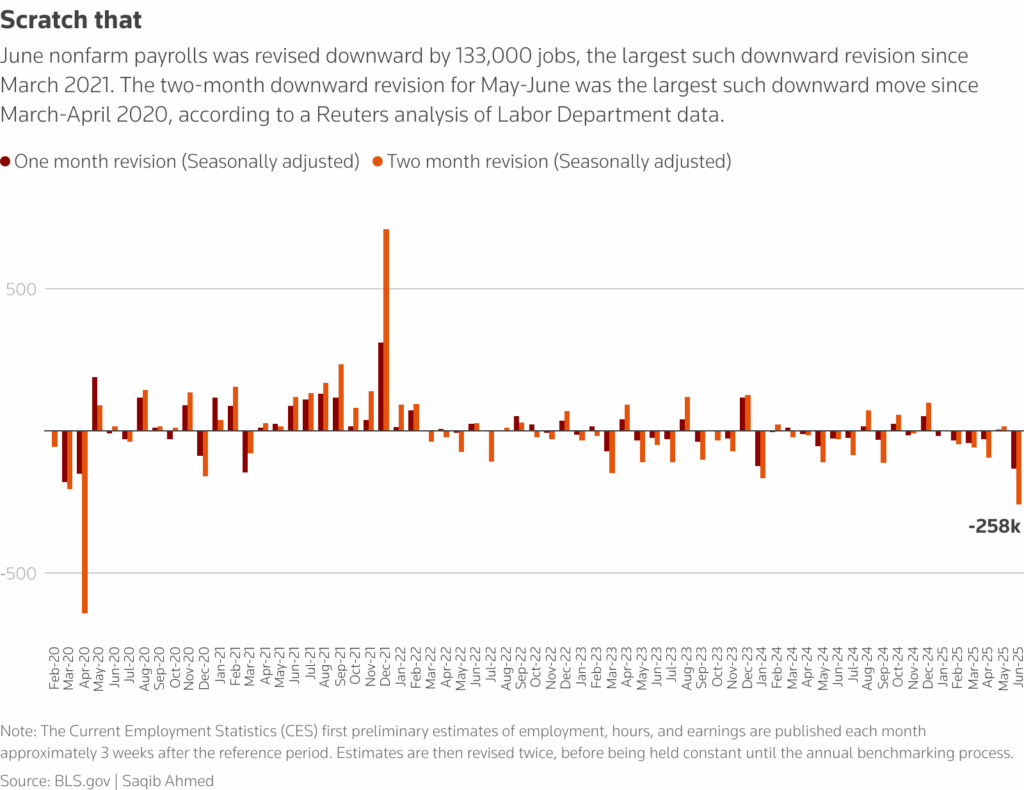

Revisions for May and June came in well above the norm, the Bureau of Labor Statistics said. It gave no reason for the revised data but noted that “monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.”

May’s nonfarm payroll gain was slashed by 125,000, from 144,000 to just 19,000, while June’s downward revision was by 133,000. In total, employment over the two months is now 258,000 lower than initially reported.

Spencer Hakimian, founder of macro hedge fund Tolou Capital Management, said layoffs across several government departments, part of U.S. President Donald Trump’s plans to reduce wasteful government spending, have prompted him to rely more heavily on alternative measures of economic strength than just government data, such as credit card data, and data from Truflation, an independent inflation index alternative to official government inflation measures.

Fed Chair Jerome Powell said in a press conference on Wednesday the labor market remained strong, and that the central bank was still in the early stages of grasping how Trump’s overhaul of import taxes and other policy shifts would play out for inflation, employment, and economic growth.

“Had those figures been the initial prints a month or two ago it would have significantly changed the labor market narrative over the entire summer,” said Adam Hetts, global head of multi-asset and portfolio manager at Janus Henderson Investors, in a note.

Treasury yields, which move inversely to bond prices, dropped after the data, with benchmark 10-year yields down by a whopping 15 basis points in mid-morning trade at 4.251% from about 4.4% before the data was published – their biggest daily drop since April.

Two-year yields were down by about 20 basis points to 3.753% from 3.951% earlier on Friday, registering their biggest daily decline since August last year.

Stocks declined too, also weighed on by Trump’s latest tariffs salvo. The benchmark S&P 500 index .(.SPX), opens new tab was down 1.5% in late morning trade, bringing stocks to their lowest since early July.

The deterioration in the labor picture comes amid steep U.S. tariffs on large trade partners that – while not as high as feared earlier this year – are still largely expected to worsen inflation and slow economic activity.

“With job creation at stall-speed levels and the tariff headwind lying ahead, there’s a strong possibility of a negative payroll print in the coming months which may conjure up fears of a recession,” said Jeff Schulze, head of economic and market strategy at ClearBridge Investments.

Reporting by Davide Barbuscia; Additional reporting by Carolina Mandl; Editing by Alden Bentley and Andrea Ricci