Wednesday, September 7, 2022 05:03 PM

Source: Bloomberg by Eliza Winger (Economist)

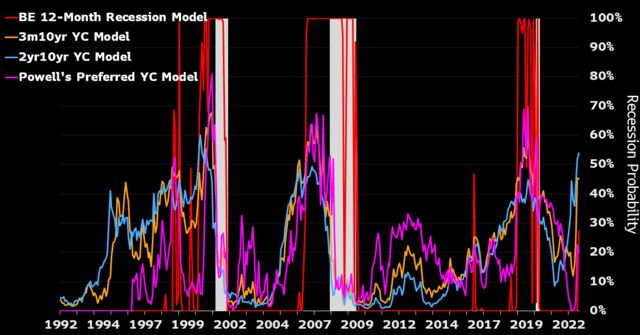

The inversion of the 10-year/2-year yield curve steepened in the past month, while macroeconomic data mostly surprised to the upside, suggesting resilience in the economy’s underlying growth momentum. On net, Bloomberg Economics’ model points to a 30% chance of recession in the next 12 months, unchanged from a month ago.

- Conditions in the labor market remained robust with job gains widespread in August, even in industries acutely sensitive to higher interest rates such as construction and real estate. That helped to buffer our model-estimated probability of recession in the next 12 months.

- Expected business conditions a year from now improved in the University of Michigan survey, a result of lower gasoline prices freeing up disposable income for discretionary items.

- Pulling in the opposite direction, the spread between 2-year and 10-year US Treasury yields turned more negative in August. A recession-probability model that includes only this indicator would suggest a heightened risk of a downturn — 54% — in the next 12 months.

- While the near-term probability of recession is low, the chance of it happening in 19-24 months remains elevated. A swiftly deteriorating housing market, steepening yield curve, and rapidly rising interest rates contribute to our baseline view for a recession in 2H 2023.

Recession Risks Within Next 12 Months

A string of surprisingly strong economic prints indicate that imminent recession fears were overdone. The labor market, in particular, pointed to solid demand for workers and resilient labor-income growth. Consumer confidence and the latest activity indicators (both manufacturing and services) surprised on the strong side, adding to evidence that the economy is not on the brink of recession.

On the other hand, our yield-curve recession-probability models 12 months ahead showed higher recession risks (rising to 54%), based on the further inversion of the 10-year/2-year curve. The probability of recession based on the 10-year/3-month curve remained unchanged at 45%, still higher than the 30% top-line recession reading.

Recession probability based on the Fed’s preferred alternative — the near-term forward spread — was lower at about 20%, but remained elevated. Assuming economic conditions deteriorate amid the Fed’s restrictive monetary-policy stance, the near-term forward spread will also likely signal heightened danger ahead.