Matthew Boesler

Bloomberg

December 21, 2023

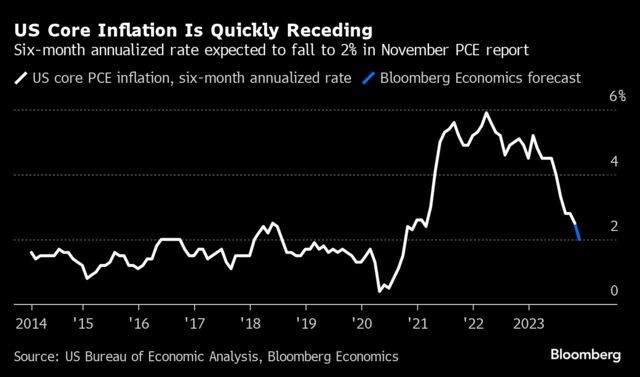

- Core PCE likely hit 2% target on six-month annualized basis

- Similar outlook for next six months seen prompting Fed easing

The US inflation outlook was already steadily improving in recent months, but last week, right in the middle of the Federal Reserve’s two-day policy meeting, the dam finally broke.

Monthly reports on consumer and producer prices published on the mornings of Dec. 12 and Dec. 13 indicated inflation over the last six months — as measured by the Fed’s preferred inflation gauge— has likely returned to the central bank’s 2% target on an annualized basis.

The surprising development led some Fed officials to make hasty revisions to their projections set to publish on the afternoon of the 13th. It also increased confidence among forecasters the next six months will look similarly subdued.

A monthly report from the Bureau of Economic Analysis due Friday morning is poised to make the achievement official, helping cement the case for lower interest rates in the coming quarters.

During 2022 and the first half of this year, Fed watchers got used “to just focusing on realized inflation,” said Blerina Uruci, the chief US economist at T. Rowe Price. “Now, the Fed is focusing on the outlook for inflation” to avoid undershooting its target, she said.

The Fed’s preferred inflation gauges — the personal consumption expenditures price index and the measure excluding food and energy — use several inputs from the pair of Bureau of Labor Statistics reports published last week.

Together they showed softening in key categories like goods excluding food and fuel, financial services and certain health care components, leading forecasters to revise down their estimates for the PCE price measure.

Revisions to gross domestic product figures published Thursday offered more good news: The core PCE price index increased at a 2% annual rate in the third quarter, the slowest since the end of 2020.

“Far from facing a widely expected ‘last mile’ problem, core PCE inflation appears to have slowed” from 4% annualized in the first half of 2023 to 1.9% in the second half of the year, Goldman Sachs economists led by Jan Hatzius said in a Dec. 13 note to clients.

Fed Chair Jerome Powell and his colleagues are now set to cut interest rates “earlier and faster,” beginning in March, “to reset the policy rate from a level” that most policymakers “will likely soon see as far offside with inflation trending near 2%,” they said.

Goods Prices

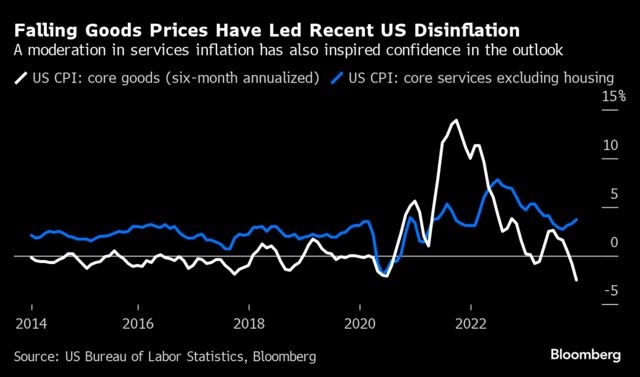

Many economists pointed in particular to broad-based weakness in goods as a big aspect of the surprise softening.

“A very simple example is, apparel prices in November in the consumer price index fell by the most in any November since 1942,” said Omair Sharif, president of Inflation Insights LLC. “We saw that in other categories like household furnishings, furniture prices, electronics. You name it, and core goods have been much weaker than expected in the last month or two.”

While merchandise has been an important driver of faster-than-expected disinflation in recent reports, services prices — an area Fed officials have been particularly focused on this year — have also largely been rising at a slower rate. That’s a big reason why forecasters are becoming more confident that the next six months will show overall inflation staying close to the Fed’s 2% target.

“The evidence suggests the economy can grow at a modest pace at the same time inflation comes down,” said Michael Gapen, the chief US economist at Bank of America. “That puts the Fed in the enviable position of likely being able to follow inflation down while not attenuating demand as much as they thought they’d have to.”

Even so, there are a few potential bumps in the road left to clear in the first quarter.

Lower stock prices helped drag financial services components of the price index lower in recent months, but fresh highs in the equity market since last week’s Fed meeting will probably push those components up again.

Read More: Rising Stock Prices Threaten Progress on Powell Inflation Gauge

Increases in rent — the largest and most important component of the price indexes — are widely expected to moderate based on leading indicators, though the exact timing is unclear. There is also uncertainty around upcoming changes to seasonal adjustments of the monthly inflation data.

None of that, however, is enough to dissuade forecasters from rejecting the optimism implicit in the latest figures.

“I don’t know that we had actual empirical evidence to suggest that the ‘last mile’ would be hard, but people ran with that line,” Uruci said. “I mean, it sounded interesting.”