Summary by Bloomberg AI

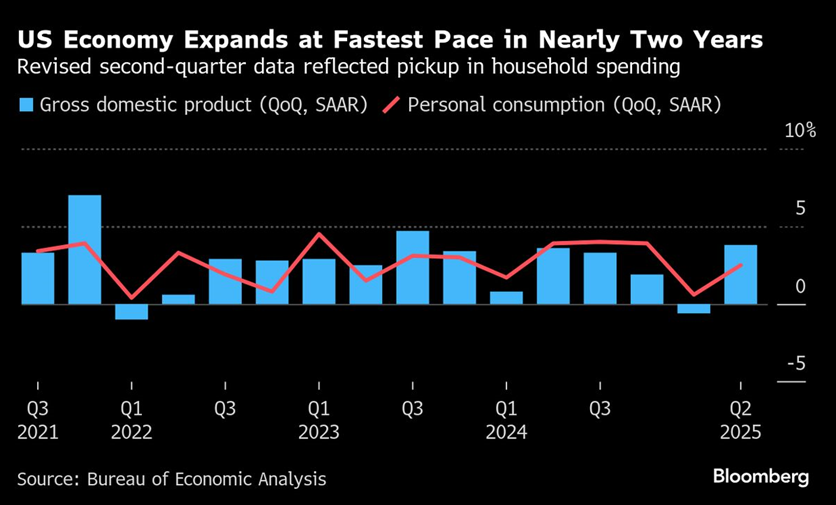

- The US economy grew at a revised 3.8% annualized pace in the second quarter, stronger than the previously reported 3.3% advance.

- The economy rebounded in the second quarter after a contraction in the first quarter, with consumer spending advancing at a 2.5% annualized pace and business investment expanding at a 7.3% rate.

- The revisions paint a picture of an economy that quickly rebounded from the initial shock of the pandemic and has since transitioned to a period of steadier, trend growth with lingering inflation.

By Molly Smith

09/25/2025 08:37:32 [BN]

(Bloomberg) — The US economy grew in the second quarter at the fastest pace in nearly two years as the government revised up its previous estimate of consumer spending.

Inflation-adjusted gross domestic product, which measures the value of goods and services produced in the US, increased at a revised 3.8% annualized pace, a Bureau of Economic Analysis report showed Thursday. That was stronger than the previously reported 3.3% advance and followed an outright contraction in the first quarter.

The BEA also issued its annual update of the national economic accounts, which showed real GDP still increased at an average annual pace of 2.4% from 2019 to 2024. The revisions paint a picture of an economy that quickly rebounded from the initial shock of the pandemic and has since transitioned to period of steadier, trend growth with lingering inflation.

The latest quarterly GDP data confirm the economy rebounded in the second quarter after a monumental surge in imports at the start of the year, when companies were racing to stock up ahead of President Donald Trump’s tariffs. The third quarter is also looking solid, with recent reports illustrating resilient consumer spending and business outlays for equipment.

“The economy is clearly recovering from the shock of tariff implementation,” Chris Low, chief economist at FHN Financial, said in a note. “Accelerating growth should mean stronger job growth within the next few months.”

Before Thursday’s figures, the Federal Reserve Bank of Atlanta’s GDP Now estimate penciled in a 3.3% rate of growth in the July-September period. However, some economists are less upbeat about growth in the fourth quarter as weaker employment dims prospects for consumer spending.

Forecasters expect activity to only pick up somewhat in 2026, partly due to Trump’s tax law and lower interest rates, with most forecasters expecting sub-2% growth for the next few years.

Separate data for the month of August released Thursday showed orders for business equipment increased at a solid clip while the merchandise trade deficit narrowed by more than forecast. Initial applications for unemployment benefits fell last week to the lowest since mid-July.

The S&P 500 opened lower and Treasury yields pared gains.