6:29:00 AM

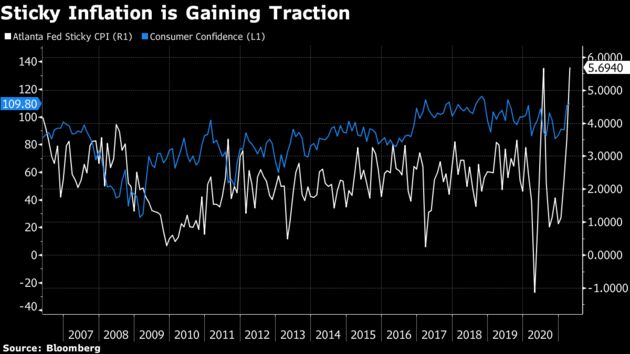

Traders should pay close attention to the latest consumer confidence reading because it could have an impact on interest rates. The data being released this morning tracks with inflation, particularly the type that is not transitory.

Headline inflation has been largely driven by rising food and energy prices, which the average consumer feels immediately. Economists call these items “flexible” because their prices react to economic conditions. In this case, flexible inflation does appear to be transitory, a sign of a growing economy because consumer confidence is rising in parallel.

However, the costs of other goods and services like household furnishings or repairing a car don’t change much based on economic conditions. They’re considered “sticky”. And sticky CPI is a better predictor of future inflation trends because of the expectations naturally embedded in the series, according to the Atlanta Fed’s Michael Bryan and Brent Meyer. If producers of these goods and services can’t change prices as frequently, they’ll set them with an eye toward where they believe inflation will be in the future.

Should inflationary pressures continue to build in 2021, which seems likely, the Fed may find itself with less of an excuse to continue pumping the economy with extraordinary monetary stimulus for much longer. Because the risk is chasing inflation higher and for a longer period of time.