Summary by Bloomberg AI

- President Donald Trump has passed a tax bill in the House, but faces a new challenge in the Senate, where he must appease customers of the ballooning US debt.

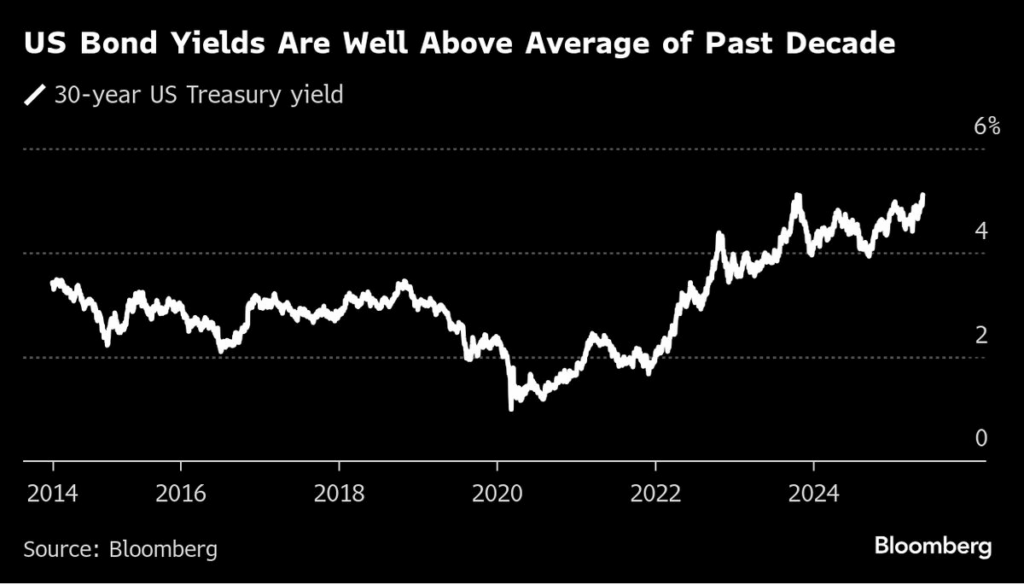

- The yield on 30-year Treasury bonds has passed 5%, injecting a dose of harsh economic reality into Trump’s fiscal policy, and a third bond-rating provider has lowered the US sovereign grade.

- The bond market is expressing unease over the US fiscal profile, with investors questioning whether they would loan the US government money at 5% for 30 years, and warning signs are emerging that the government’s interest bill could accelerate its fiscal deterioration.

By Gregory Korte, Liz Capo McCormick and Nancy Cook

05/22/2025 09:18:55 [BN]

(Bloomberg) — President Donald Trump cut a deal with blue-state Republicans on taxes and put down an 11th-hour rebellion by conservatives over spending to get his “one big, beautiful bill” passed by the House.

But if he’s going to shepherd the signature legislative package of his second term through the Senate, he may have to reckon with an even more demanding constituency: customers for the ballooning amount of US debt.

With the yield on 30-year Treasury bonds again passing the 5% mark on Wednesday, the nation’s creditors injected a dose of harsh economic reality into Trump’s fiscal policy — and not for the first time. Last week, a third bond-rating provider lowered the US sovereign grade, projecting the nation’s debt surging to 134% of the size of the economy in 10 years, from roughly 100% today.

That’s a long way from the vision Trump offered in his March address to Congress, when he promised a balanced budget “in the near future.” The House bill features a bevy of new tax breaks for key political constituencies — tipped and hourly workers, car buyers and seniors. And indications from GOP senators suggest they’ll seek to pare back spending cuts to shield others from financial pain.

Trump’s lieutenants, including Treasury Secretary Scott Bessent, argue that the package will boost business sentiment and unlock spending and investment. Trump’s allies on Capitol Hill also see it as the centerpiece of the party’s legislative agenda, and a counterweight to the uncertainty prompted by Trump’s haphazard tariff policies.

Bond market participants see something else.

“People are getting fed up. It’s clear that there are no adults in the room in Washington. Zero. No accountability,” said John Fath, managing partner at BTG Pactual Asset Management US LLC. “You have to ask yourself, what is it going to take? It’s going to be the price action.”

The action has been notable already. As Trump was putting pressure on House members to back the tax bill, the Treasury on Wednesday found tepid demand at an auction of 20-year bonds. Not just Treasuries, but stocks, too, tumbled as investor concern over the US fiscal profile deepened.

The moves were reminiscent of Trump’s wrangle with the bond markets last month, when he blinked. In the early morning hours of April 9, Treasury yields surged as Trump’s steep retaliatory tariffs — the highest in more than a century — went into effect. While a months-long slump in equities barely fazed him, the bond market got his attention.

“The bond market is very tricky,” he said at the time, announcing that he was suspending most of the tariffs just hours after they went into effect. “But yeah, I saw it last night where people were getting a little queasy.”

Interest Bill

If Treasuries continue to stay queasy, the higher yields not only threaten to dampen economic growth — as they translate into higher borrowing costs for everything from homes to cars — but to accelerate the government’s fiscal deterioration. As rates rise, so does the Treasury’s interest bill.

“Investors are now asking themselves a very difficult question, which is, would you loan the US government money at 5% for 30 years?” said George Catrambone, head of fixed income and trading at DWS Americas. “That’s the question that we have and are facing the long end of the Treasury market.”

Unlike in April, Trump has not had Bessent — who has been speaking to investors in Saudi Arabia and meeting with Group of Seven Finance Ministers in Canada — hovering over his shoulder as he negotiated the House’s tax bill in the Oval Office. It was Bessent, a hedge fund veteran, who helped persuade Trump to pause the tariffs when bond markets sent distress signals.