By Michael Mackenzie and Alice Atkins

06/11/2025 05:50:44 [BN]

Summary by Bloomberg AI

- US Treasuries surged after data showed underlying US inflation rose in May by less than forecast for the fourth month in a row.

- Traders priced in 48 basis points of Fed easing before the end of the year, with a cut in September now more likely.

- The Fed has held policy steady this year after adjusting their reference rate lower to 4.25%-4.5% in December.

(Bloomberg) — US Treasuries surged as easing US consumer inflation prompted traders to increase their wagers on more than one Federal Reserve interest-rate cut this year.

The advance on Wednesday pushed yields lower across maturities after data showed underlying US inflation rose in May by less than forecast for the fourth month in a row. The monetary policy-sensitive rate on two-year notes dropped seven basis points to 3.95%.

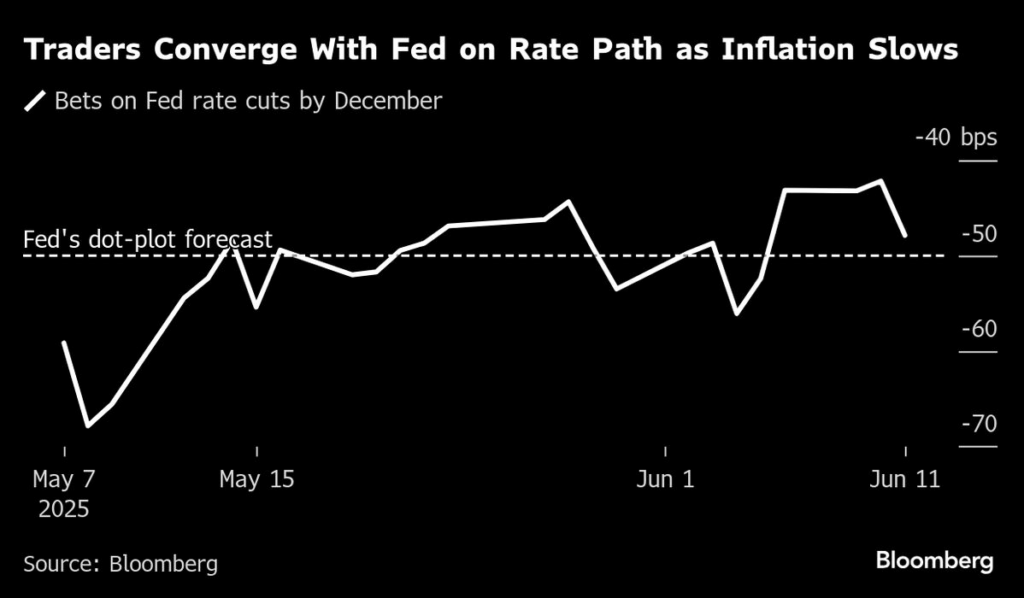

Traders priced in 48 basis points of Fed easing before the end of the year, compared to about 42 basis points at Tuesday’s close. While the Fed’s next move is fully priced in for October, traders increased expectations for a cut in September.

“It’s a clean downside surprise and not just in the headline. The breadth of the softening gives the Fed real cover,” Haris Khurshid, chief investment officer at Chicago-based Karobaar Capital. “One cut is back in play, no question,” and two are possible if wholesale prices and labor market data cooperate.

The Fed has held policy steady this year after adjusting their reference rate lower to 4.25%-4.5% in December. Officials have said they are waiting to see to what degree the cost of President Donald Trump’s tariffs ripples into measures of inflation and boosts expectations for further price pressures, before resuming an easing cycle.

The 10-year yield was four basis points lower at 4.43% ahead of a $39 billion auction of the benchmark notes scheduled for 1 p.m. New York time.