Morgan Stanley is betting on better-than-expected results for Apple next week, which should spur the stock to outperform amid lackluster gains in 2021.

The Wall Street firm’s Apple analyst Katy Huberty — ranked the No. 1 analyst in 2020 by Institutional Investor for IT hardware and electronics manufacturing services — told clients that strength in Apple’s products and services should allow the company to top expectations.

Morgan Stanley has “high confidence in March quarter beat as ecosystem strength set to shine,” Huberty said. We “believe that a strong beat and raise March quarter combined with more muted institutional … positioning relative to F1Q earnings will help AAPL shares re-rate after [year to date] underperformance.”

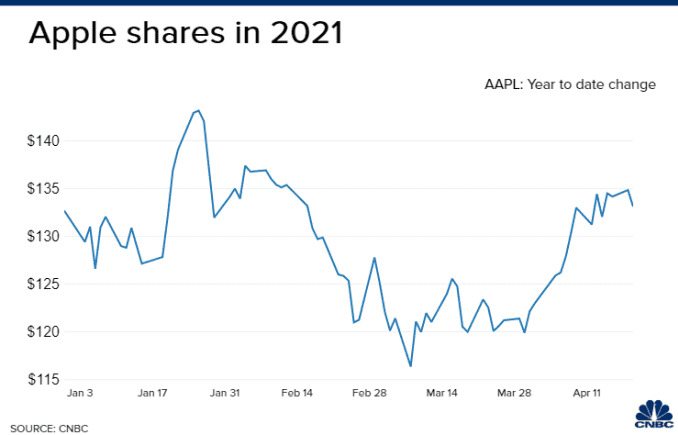

Apple shares are about flat in 2021, versus the S&P 500′s 10% gain. Technology stocks have been pressured this year amid the threat of rising interest rates. Huberty said Apple shares will regain its market-leading status once the company tops expectations for earnings, amplified by Tuesday’s Apple launch event.

The company is set to report results next Wednesday after the bell.

Apple announced a colorful new iMac and an updated iPad Pro with 5G and the M1 chip that’s also used in the company’s desktop computers. Apple also announced an AirTag lost-device tracking gadget and a refreshed Apple TV 4K with a brand-new remote.

Morgan Stanley is expecting earnings per share of $1.03, which is 4% to 5% above consensus, and revenue of $80.2 billion for the March quarter. Huberty also raised slightly the iPhone revenue forecast for the quarter.

“Most importantly, we expect next week’s report to highlight the strength of Apple’s diverse product and services ecosystem, which continues to push the boundaries of what is possible on a computing device, and which was strengthened today by new iMac, iPad and AirTag product launches,” said Huberty.

Morgan Stanley also sees upside for Mac and iPad sales due to strength in the consumer and education market.

Huberty is forecasting a new $60 billion buyback authority and 10% year-over-year dividend increase.

“Apple will update its capital return plans during March quarter earnings next week and we expect management’s messaging to remain unchanged — the goal is to reach net cash neutral over time,” she added.

Huberty also raised Apple’s 12 month price target to $158 per share from $157 per share.

Shares of Apple were down slightly in morning trading Wednesday.