By Alexander Saeedy and AnnaMaria Andriotis

Oct. 15, 2025 12:57 pm ET

Boom in dealmaking, higher spending point to a healthy economy; bears watch frothy stock prices, weakening job market

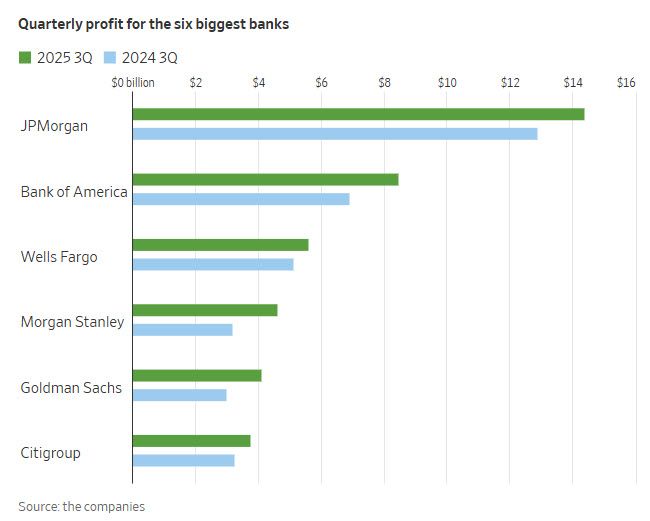

Banks including JPMorgan, Bank of America, and Goldman Sachs third-quarter profit and revenue that beat analysts’ expectations, buoyed by a jump in dealmaking, corporate spending and healthy consumer activity. Growing confidence from business executives, low delinquencies on consumer debts and a rallying stock market have all helped generate profit across the banks.

As a group, the country’s six largest banks earned nearly $41 billion in the past three months, up 19% from a year ago.

“You see strong consumer spend and stable deposits and those things just kind of paint a picture of a consistently strong consumer,” Wells Fargo Chief Executive Charlie Scharf said.

At the same time, executives were pointing out causes for concern about the world’s biggest economy. Some of the more bearish voices on Wall Street continue to point to more than 10 years without a prolonged recession or credit cycle, near record-high stock prices and the unexpected collapses of two companies in the automotive world as signs that not all is well in Camelot.

“When you see one cockroach, there’s probably more,” JPMorgan CEO Jamie Dimon said. “Everyone should be forewarned.”

The economy has been flashing conflicting signals, with the job market cooling, inflation still elevated and the stock market breaking several records this year. The picture is getting even murkier thanks to the federal government shutdown, which could leave millions of Americans without paychecks and means investors won’t be receiving regularly scheduled macroeconomic data about employment and prices.

That will draw more attention to corporate earnings for insight on the health of consumers and businesses big and small. Banks in particular are viewed as barometers for the broader economy because they see details of the financial health of millions of U.S. households and companies, watching saving and spending habits that signal if customers are cutting back on expenses like travel or eating out.

In recent months, national gross domestic product and other indicators showed the economy was holding steady. Still, concerns about a sluggish job market have raised fears about the financial health of lower-income households.

Federal Reserve Chairman Jerome Powell said on Tuesday that the U.S. labor market has continued to weaken, signaling continued likelihood that the Fed would cut rates again this month despite some lingering inflation concerns.

For now, most banks and financial-services companies say the economy is holding up, even if they remain wary about potential cracks.

Bank of America, one of the largest consumer and small-business banks in the country, said it felt good about what it was seeing on Main Street. Consumers continued to make more purchases on credit cards, but they are also carrying bigger balances month-to-month, a sign they are stretching further to spend.

Card issuer Synchrony Financial which caters to a range of consumers, including those with lower credit-scores, said spending was still increasing but delinquencies and late payments were down.

“Look, we still think the consumer is in pretty good shape,” CEO Brian Doubles said. “They’ve been very resilient. We’re not really seeing any signs of weakness.”

Investors meanwhile are putting more money to work in the stock market. BlackRock brought in $205 billion in new client money during the quarter, lifting its total assets to $13.5 trillion.

Assets in Morgan Stanley’s wealth business increased across the board for both wealthy and mom-and-pop investors. In its unit where financial advisers oversee investments mostly for wealthy clients, assets increased 17%. That figure rose 24% in the retail wealth business, mostly consisting of E*Trade. The average daily number of retail trades the company handled rose 24%.

Those worried the good times might not last are pointing to recent blowups in the credit world. The high-profile bankruptcies of auto lender Tricolor and auto supplier First Brands because of alleged fraud and accounting irregularities have ensnared some of the country’s biggest banks. JPMorgan reported a $170 million charge because of Tricolor while Bank of America said it was a lender to First Brands, whose CEO resigned on Monday.

Executives were divided on whether the bankruptcies signaled underlying problems in the economy or if they were one-offs.

Dimon, often more willing than most to focus on the dour side, said he was concerned about how investors appeared nonchalant about risks in credit, although he acknowledged consumer defaults looked normal so far.

Other risks hanging over the economy include growing trade tensions with China and the government shutdown. Treasury Secretary Scott Bessent said Wednesday that the government shutdown could be costing the U.S. economy as much as $15 billion a day, but he also tried to temper the concerns about a trade war reopening, saying negotiations with Canada are “back on track.”

“There is a lot of geopolitical uncertainty…and there is considerable uncertainty around how the economy manifests itself in terms of Fed policy,” said Ted Pick, CEO of Morgan Stanley. “To just ignore that would be silly.”