8:50:12 AM

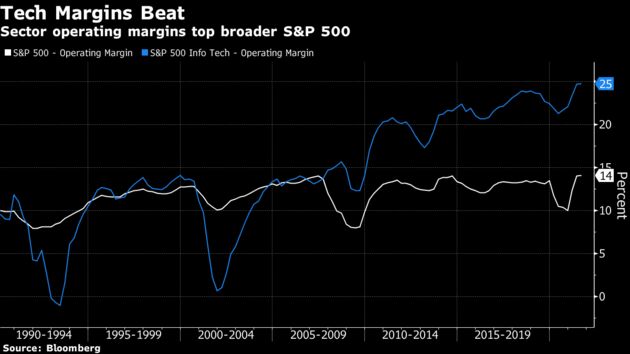

Sectors linked to post-pandemic reopening — energy, real estate and financials — are leading the S&P 500 higher this year. But tech may take over, with margin growth in focus for investors concerned about cost inputs and slowing economic growth.

Tech is viewed as generally more likely to weather inflation than other industries that need to grapple with rising materials and labor costs. The increasing dominance of tech firms with high margins is lifting the S&P 500’s overall profit margin. The sector is likely to keep on making an outsized contribution to margins.

The share of sales generated by tech and communications sector stocks has jumped to a record high of 24% from 16% in 2008, while those stocks carry an average net profit margin of 20%, twice the rest of the S&P 500, according to Goldman strategist David Kostin. That rising tide looks set to lift all boats.

Semiconductor companies have also shown notable margin growth this quarter. ON Semi’s adjusted margin quarterly growth of 320 basis points was a recent standout, helping propel the Philadelphia Semiconductor Index to fresh records. Keep watching the metric for signals about potential stock rallies to come.