The first two weeks of U.S. earnings reports suggest the uncertainty caused by the pandemic is easing, supporting the continuing run higher for the S&P 500.

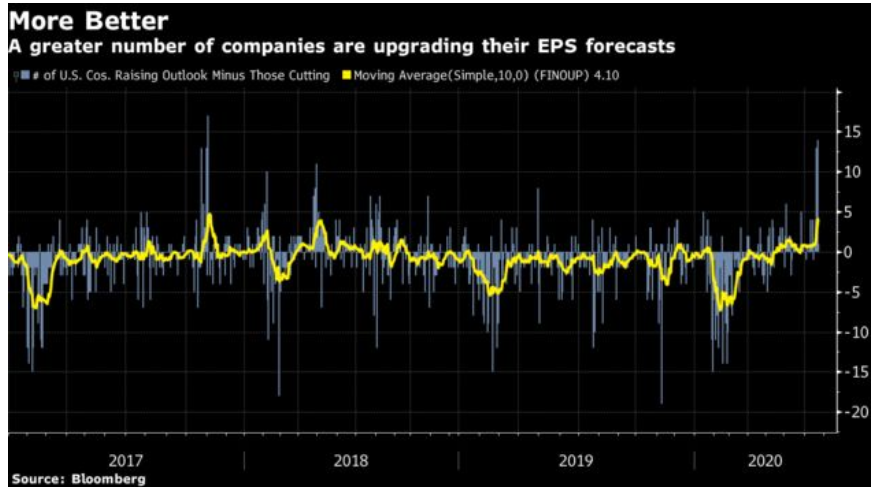

The clearest sign of this turn to the better is the net number of companies raising their forecasts. The 10-day moving average is perched at the highest level in over two years.

And unlike 1Q, this round of earnings is producing a normal looking spike in the percentage of companies beating analyst estimates, with some 82% leaping Wall Street’s bar. Three months ago the same figure was ~65%.

FactSet did a study to see if there was a change in corporate management given so many companies yanked their outlooks in 1Q. The firm notes a 40% increase in the number of companies providing an annual outlook compared to the same time in 1Q. The numbers are small, just 10 companies giving guidance after declining to do so earlier this year. However, FactSet also notes a surge in the number of corporations which are raising their full-year forecasts versus the same time in 1Q.

Under-promise and over-deliver are words to live by if your job is to run a publicly traded company. While by no means a sure guarantee of better times ahead, rosier company outlooks are at least a sign that the awful days of the first wave of the pandemic are behind us and that executives — just like the broader population — are becoming more comfortable with what the new normal looks like. And with more confidence likely comes a continuing grind higher in stock prices.

Andrew Cinko Editor, U.S. Markets, Princeton