by Christopher Combs

Silicon Valley Capital Partners

09/05/2025

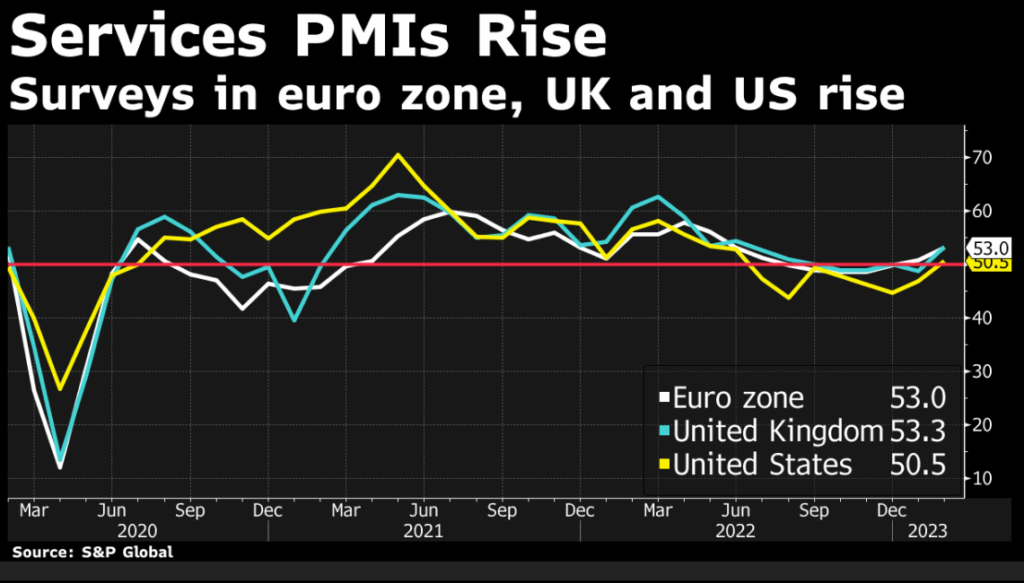

Services PMIs have bottomed and are now expanding, marking a pivotal shift in the global economy. This turning point underscores both opportunity—through stronger earnings and output—and risk, as inflationary pressures mount and policy options narrow.

Figure 1: Services PMIs in the Eurozone, United Kingdom, and United States

Source: S&P Global

Interpretation: The chart demonstrates the dip below 50 during 2022 and early 2023, followed by a synchronized rebound across all three regions. This pattern indicates that services activity has troughed and is now in recovery.

1. Introduction

The Services Purchasing Managers’ Index (PMI) is one of the most widely followed indicators of real-time economic conditions. Because services dominate the modern economy—representing nearly 70% of GDP in the United States and Eurozone—shifts in this index provide critical insight into both growth potential and inflationary risks.

Recent data show that Services PMIs in the U.S., Eurozone, and U.K. have bottomed and are now expanding. This marks a decisive turning point: the global economy is entering a new phase of expansion that, while positive for output and earnings, could also bring inflationary momentum and overheating pressures.

2. Defining the Services PMI

The Services PMI is a diffusion index based on surveys of executives across non-manufacturing industries such as technology, finance, transportation, healthcare, hospitality, and education. Respondents report whether conditions are improving, stable, or deteriorating across key categories:

-

Business activity (output of services)

-

New orders (domestic and export demand)

-

Employment

-

Input and output prices

-

Supplier delivery times

A reading above 50 signals expansion, while below 50 indicates contraction. The distance from 50 shows the strength of momentum.

3. Recent Data: Signs of a Bottom

Services PMI readings for August confirm that the sector has bottomed and turned upward:

-

Eurozone: 53.0 (expansion)

-

United Kingdom: 53.3 (expansion)

-

United States: 50.5 (modest expansion)

4. Business Cycle Interpretation

Placing these developments in the business cycle framework:

-

The services sector has exited contraction.

-

Expansion is underway, supported by rising demand and improving business activity.

-

Risks of overheating are increasing: demand growth may outpace supply capacity, leading to wage and price inflation.

Thus, the economy appears to be in the late-expansion phase, where growth remains strong but inflationary pressures build.

5. Employment Implications

-

United States: Hiring remains cautious, but further demand expansion could reignite labor shortages and wage pressures.

-

Eurozone and U.K.: Employment growth is already accelerating, with services firms adding workers at the fastest pace in over a year.

Employment strength in services typically reinforces consumer spending, but also contributes to persistent inflation.

6. Interest Rate Policy

The rebound in services activity complicates central bank decisions:

-

Federal Reserve: Pressured to weigh strong services growth against inflation risks, limiting scope for rate cuts.

-

European Central Bank: Confronts higher input prices, which may prevent rapid easing even as manufacturing struggles.

The takeaway: expansionary PMIs reduce policy flexibility, as central banks must guard against overheating.

7. Trade and Earnings Impacts

Global services expansion supports trade in finance, technology, and tourism, but lingering tariff and supply chain disruptions constrain services tied to goods logistics.

For corporations, the services rebound supports earnings momentum, particularly in U.S. equity markets. Technology, financial services, healthcare, and travel are all poised to benefit. The risk lies not in growth, but in policy tightening should inflation accelerate.

8. Conclusion

Services PMIs have bottomed and are now expanding, marking a pivotal shift in the global economy. This turning point underscores both opportunity—through stronger earnings and output—and risk, as inflationary pressures mount and policy options narrow.

For investors, the message is clear: the services rebound signals a supportive backdrop for markets in the near term, but vigilance is required as the business cycle edges closer to the overheating stage.