Simon Property Group, the largest mall owner in the US, noted the strength of higher-income consumers on its 3Q earnings call as a key factor supporting its projection for flat to higher reported retailer sales for the portfolio in 2023.

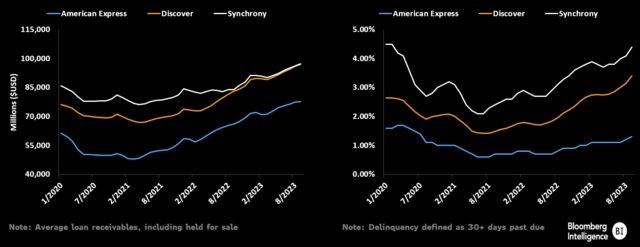

Average Loan Receivables, Delinquency Rates

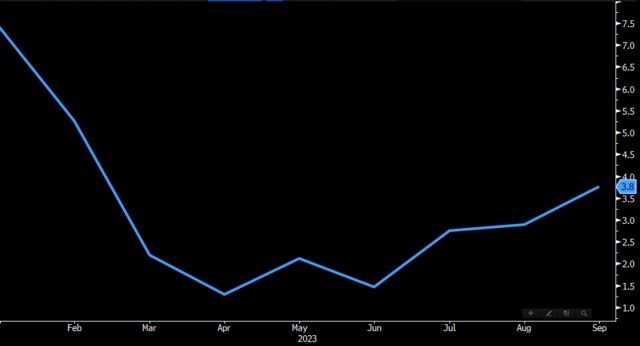

US Adjusted Retail Sales Year-Over-Year Change (%)

Rising credit-card balances and delinquency rates, the resumption of student-loan repayments and lower savings present challenges, especially for the lower- to middle-income consumer. This group is already taking a cautious approach, but we think buy now, pay later options and less travel or eating out could support continued retail sales resilience. In addition, the higher-income shopper is solid and continues to spend.

US retail sales growth has shown improvement in 2H, with September’s seven-month high likely reflecting back-to-school shopping that was more consolidated and last-minute compared with 2020-22 — trends we expect could also show in November and December as consumers wait for big deals to make holiday purchases.

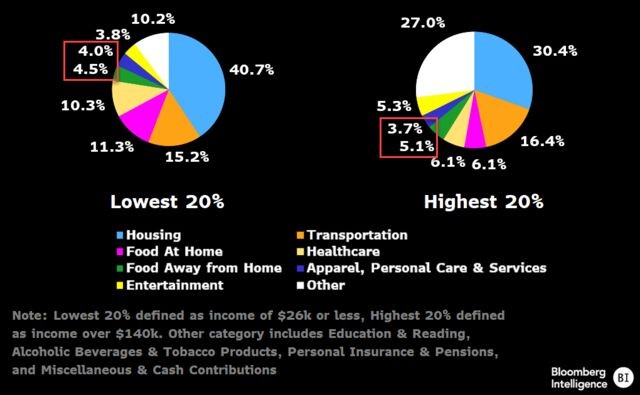

Share of 2022 Expenditures by Income

Dining out, which commanded a 4.5-5.1% share of 2022 expenditures, based on Bureau of Labor Statistics data, may be an area where consumers pull back, even for higher-income bands. A shift away or trade down in eating out, plus the possibility for further moderation in travel, could make room for spending in other discretionary categories. We see opportunity for sales growth for the holiday season and in 2024 for apparel, athleisure, beauty and electronics. For some retailers, like Best Buy or Macy’s, sales gains would mark a reversal from trailing 12-18 month trends as demand is showing signs of improvement and year-over-year comparisons are getting easier.

Demand for beauty remains strong, with Ulta poised for at least 9% top-line growth in 2023, which is consistent with historical outperformance in a challenging economy.

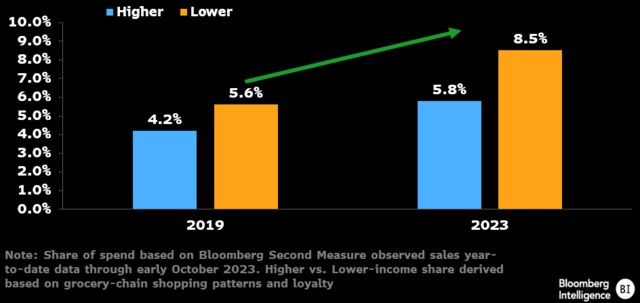

Bloomberg Second Measure: Value Share of Spending

Consumers across all income brackets have already shown a shift to value — a trend that we expect will hold well into 2024. The share of spending at discount and warehouse clubs through early October is about 1.5x that of 2019 and greater than 2022 for both high- and low-income households, based on observed sales data from Bloomberg’s Second Measure. The strong focus on value is likely to drive elevated promotions for other retailers during the critical holiday-selling season and into 2024, as they compete for wallet share.

Retailers such as Lululemon, Williams-Sonoma and Dick’s Sporting Goods, which have a higher-income customer base, may be better positioned to limit such margin-dilutive discounts, while Lowe’s, Macy’s, Best Buy and Home Depot could be more pressured to increase promotions to drive sales

Bloomberg Second Measure: BNPL 2021 Adopters