- Question now is ‘Should we hike more?’ Fed chief says

- Powell downplays previous projections for more tightening

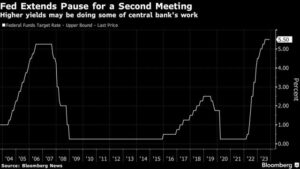

Federal Reserve Chair Jerome Powell hinted the US central bank may now be finished with the most aggressive tightening cycle in four decades after it held off on raising interest rates for a second consecutive policy meeting.

“The question we’re asking is: Should we hike more?” Powell told reporters during a press briefing after the decision. “Slowing down is giving us, I think, a better sense of how much more we need to do, if we need to do more.”

The central bank’s policy-setting Federal Open Market Committee left its benchmark rate unchanged Wednesday in a range of 5.25% to 5.5%, following a two-day meeting in Washington. Officials signaled in a post-meeting statement that a recent rise in longer-term Treasury yields reduces the impetus to hike again, though they left open the door to another increase.

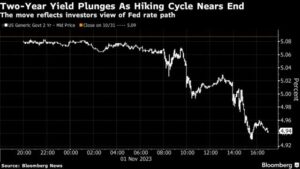

Powell’s dovish pivot cheered markets, with the S&P 500 index closing more than 1% higher on the day. The 10-year US Treasury yield tumbled below 4.75% for the first time in two weeks, extending moves initially triggered in the morning by the Treasury Department’s plans to slow the pace of increase in its long-term debt sales.

Futures were pricing in a roughly one-in-four chance of another rate hike by January, compared to around 40% the day before.

“The Fed is basically saying: We don’t think we will have to do much more from here,” said Bill Dudley, a Bloomberg Opinion contributor and former New York Fed chief. Powell “feels very confident the Fed has done a lot.”

With inflation still well above the Fed’s 2% target and economic growth at the highest in almost two years, Powell and his colleagues retained the option to move again if necessary.

The Fed chief told reporters that decisions will be made “meeting by meeting,” and noted the committee will have an abundance of data, including two employment reports and two inflation reports — as well as more data on financial conditions and geopolitical risks — before December. He said Fed leaders are monitoring the Israel-Hamas war for economic implications.

“The Fed is not in a position to declare victory,” said Rubeela Farooqi, chief US economist at High Frequency Economics. “That means that officials will keep the option of further tightening on the table, for now.”

Dot Plot

Still, Powell distanced himself Wednesday from the “dot plot” of quarterly interest-rate projections last updated after the FOMC’s previous meeting in September, saying it only represented officials’ individual views at a particular point of time.

“That’s not like a plan that anybody’s agreed to, or that we will do,” he said. “I think the efficacy of the dot plot probably decays over the three-month period between that meeting and the next meeting.”

Powell repeatedly said the committee was moving “carefully,” a wording that often has signaled a low likelihood of any immediate change in policy. He also said risks to the outlook have become more two-sided as the tightening campaign nears its end.

The chair brushed aside concern over rising inflation expectations reflected in a recent University of Michigan survey – a survey he had previously cited in June 2022 as partial justification for a shift to outsize rate hikes.

“They see an opening for no recession and a soft landing, and they think that is a risk they are willing to take,” said Derek Tang, an economist at LH Meyer, a policy analysis firm in Washington. The risk is “if doesn’t turn out that way, you are behind again, and you don’t want to be behind a second time.”