Monday, September 12, 2022 08:36 AM

Source: Bloomberg: by Jessica Menton

After US stocks snapped three straight weeks of losses, investors are looking ahead to a batch of crucial inflation figures that will help determine the pace of the Federal Reserve’s interest-rate increases this year and beyond. But when it comes to corporate decision makers, there are signs that many executives believe inflation is near a peak and profits are sustainable enough to ramp up dividend payments and other uses of cash.

- With inflation running at a four-decade high, investors say Tuesday’s consumer-price data will be key to the rate outlook and the direction of the equity market. CPI is forecast to have risen 8% in August from a year earlier versus 8.5% in July, according to economists surveyed by Bloomberg. Core CPI, which strips out volatile food and energy components, is projected to be 6.1% on a year-over-year basis and remain unchanged at 0.3% month over month.

- The Fed, which is in a blackout period ahead of its Sept. 20-21 meeting, is widely expected to raise its benchmark rate by 75 basis points next week. Investors will get another fresh read on inflation in the US on Monday when the New York Fed’s Survey of Consumer Expectations is released at 11 a.m. New York time. A key measure of US producer prices is also due Wednesday, followed by the University of Michigan’s monthly consumer inflation expectations on Friday.

- Following a selloff in US stocks in recent weeks, much of the excess from this summer’s rally was removed, which may allow support to continue in September, according to Gillian Wolff, senior associate analyst at Bloomberg Intelligence. The S&P 500 Index held support at former resistance between 3,900 and 3,940 and confirmed a minor uptrend line is in play since the June low. Still, slower inflation is unlikely to sway central bankers from delivering another jumbo hike later this month, she said.

- “It all depends on the CPI data, but even if inflation comes down, we know it won’t come down fast enough,” Wolff said. “We’re so far away from the Fed’s 2% inflation target that even the best-case scenario won’t signal an end to rate increases anytime soon. It may give markets a short-term boost, but rate rises are here to stay for a while.”

- The S&P 500 never became particularly oversold in recent weeks, given the 14-day relative strength index remained above the critical 30 line and above lows reached several times this year, Wolff explained. The benchmark gauge is nearing key resistance around 4,110, an important level that could help determine the duration of the rally, she said.

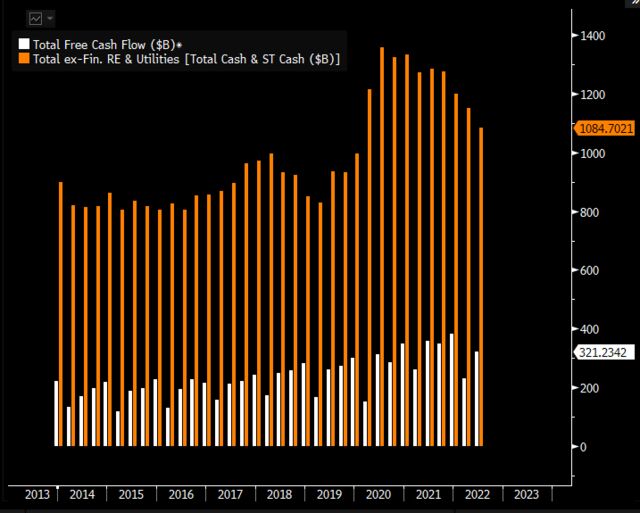

- Fundamentals may offer some help for the market. Although companies are leaning on dividends more this year as the pace of buybacks cools somewhat, all forms of cash use kept rising in the first half of 2022, suggesting Corporate America may see a relatively stable economic and inflation outlook despite investors’ fears of recession. The S&P 500’s free cash flow dropped 10.2% last quarter from a year earlier in a second quarterly decline, largely due to cost pressures, BI data show.

Source: Bloomberg Intelligence

- Still, positive signs are emerging: In the second quarter, the S&P 500’s free cash flow fell again on a rolling four-quarter basis, but capital deployment is surging, suggesting companies don’t expect rising costs to last, according to Bloomberg Intelligence. Inflation distress is picking away at free cash flow, yet balance-sheet cash is still above pre-pandemic levels, offering some cushion to payout prospects for dividend investors, according to BI senior associate analyst Wendy Soong.

- “Companies are confident that inflation is near a peak and high prices are a temporary phenomenon,” Soong said. “Dividend increases are catching up with the inflation rate. That’s a good sign that companies have confidence to distribute dividends, which means executives think costs are contained and profitability is sustainable to pay those dividends.”