JPMorgan just named Amazon a top pick for 2021, expecting the e-commerce giant to rally nearly 45% in the next year.

The Wall Street firm — which has an overweight rating on Amazon — expects the company’s share price to rise to $4,400 per share in the next 12 months.

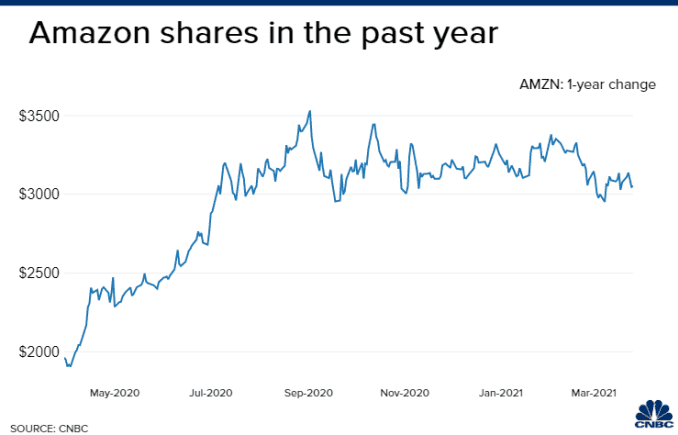

Based on the retailer’s share price of about $3,052 as of Friday’s close, JPMorgan expects the stock will rise nearly 45%. Shares ticked down on Monday morning, with Amazon trading around $3,036 at 10:17 a.m. ET.

“We believe Amazon is well positioned as the market leader in e-commerce and public cloud, where the secular shifts remain early—U.S. e-commerce represents ~20% of adjusted retail sales, and we estimate ~15% of workloads are in the cloud today,” JPMorgan internet analyst Doug Anmuth told clients.

Amazon’s cloud-computing unit saw its revenue climb 28% to $12.7 billion from $9.95 billion a year earlier.

“We believe Amazon’s flexibility in pushing first-party vs. third-party inventory and its Prime offering both serve as major advantages in its retail business, and its multi-year head start in the cloud has led to a 40%+ AWS global market share,” said Anmuth, referring to Amazon Web Services, the company’s cloud-computing platform provider.

“Amazon is also showing increased profitability, with its high-growth AWS and Advertising revenue streams also its most profitable,” he added.

Anmuth is a top-rated technology investor, with an average return of 26.4% per rating, according to TipRanks.

Anmuth also named Google-parent Alphabet, Peloton, Facebook, Twitter and Lyft as top picks.