(Bloomberg Economics) —

In the first half of 2021, frictions as the U.S. economy came back online helped push prices markedly above expectations. In 2H, growth in the U.S. is expected to stay high, and Europe, Japan and India will accelerate. With an even larger share of global supply and demand in flux in the months ahead, the outlook for inflation — and monetary policy — remains unusually uncertain.

- There’s two ways inflation could stay stubbornly high. Further frictions from reopening could mean more transient factors come into play. Or a rapid narrowing of the output gap in major economies could create the conditions for overheating — with transient inflation handing off to persistent.

- In dollar terms, 1H 2021 brought an estimated $1 trillion in global gross domestic product back online. In 2H, we forecast a $3.4 trillion increase. With substantially more of the global economy coming back online in the months ahead, frictions are more likely to intensify than moderate, and the risk of overheating will increase.

- The timing of monetary tightening has edged forward since our last forecast. We now see the U.S. Federal Reserve raising rates in 2023 and the Bank of England doing so in 2022. That timeline is more likely to move further forward than it is to go back.

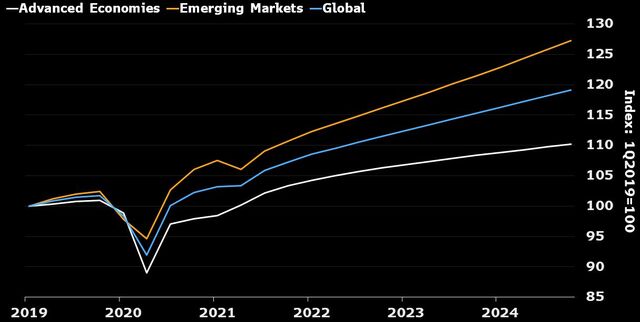

If You Squint, It’s a ‘V’ for GDP

Source: Bloomberg Economics

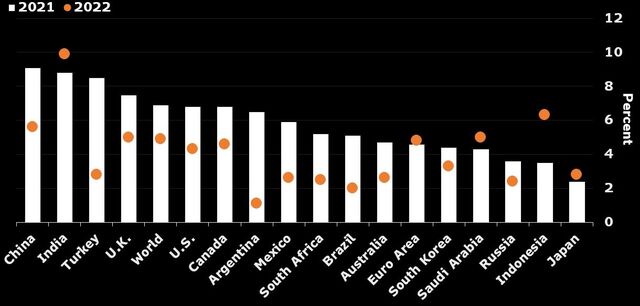

The global economy is entering the fastest stage of the 2021 recovery. After a lackluster start, when fresh waves of infection forced lockdowns in Europe and India, growth sped into the end of 2Q. With reopening under way, 3Q should be substantially stronger and momentum largely maintained through year-end. That puts global growth at 6.9% for 2021 as a whole, slowing to 4.9% in 2022.

- China is the furthest along: It’s already through the rapid stage of recovery, with growth slowing toward trend. Costs of the pandemic and stimulus have added to its debt and exacerbated the imbalance between industry and consumers, requiring Beijing to shift policy to address those long-term challenges.

- The U.S., supercharged by vaccinations and stimulus, isn’t too far behind. We expect the economy to expand 6.8% in 2021 and 4.3% in 2022. Approval of President Joe Biden’s infrastructure and families plan would add fuel to the fire, pushing 2022 growth toward 5%.

- The euro area picked up sharply at the end of 2Q. Relative to the outsize U.S. stimulus, Europe’s fiscal support looks puny. Still, in Italy and Spain, government aid will deliver a significant boost.

- Japan, heading into a double-dip recession in 2Q — the cost of suppressing a fourth wave of the virus — is lagging again. Approaching the end of his first year in office, Prime Minister Yoshihide Suga will hope the Summer Olympics give a boost to confidence and don’t become a super-spreader event.

- India, finding its footing after a catastrophic second wave of infections, is among the emerging markets bringing up the rear. A sharp drop in virus cases and an accelerated vaccination drive is now allowing the economy to open up. We anticipate a marked acceleration starting in 3Q.

Some Recover Faster Than Others (GDP, %)

Source: Bloomberg Economics

The global recovery gathering pace, and demand coming back before supply, has triggered rising prices. Bloomberg Economics’ view, in line with the near-unanimous position among central bankers, is that the current highs for the consumer price index in the U.S. and elsewhere are transitory.

Even with the latest OPEC+ crisis, base effects from last year’s low energy prices are fading. A dive into the U.S. CPI reveals short-term factors driving the bulk of the increase. Once the global economy is through a period of reopening frictions, the same structural factors that weighed on inflation ahead of the pandemic will kick in.

At the same time, it’s important to note that forecasts earlier in the year missed the extent of price pressure, there’s a lot of reopening still to come, and so the path for inflation remains uncertain. It’s worth taking a moment to access how consensus complacency on transient price pressure could be disturbed:

- On the demand side, households could splurge their pandemic savings. In the U.S., Congress could approve Biden’s multitrillion dollar jobs and families plans. On the supply side, pandemic bankruptcies and job losses may have permanently dented potential output. The combination of stronger demand and weaker supply could tip transitory into durable inflation.

- The acceleration of global growth into 3Q, with activity in Europe, Japan, India and other emerging markets picking up, is a significant and hard-to-predict variable. At a minimum, we can say that the scope for reopening frictions to trigger transitory price pressure is increased, and that a narrowing output gap brings overheating closer into view.

- Structural shifts could also play a part. The pendulum is swinging back toward workersafter decades of pro-business policies. In the U.S., backing for a higher minimum wage, support for unions and sustained higher tariffs on imports all have the potential to nudge wages and prices higher.

Further muddying the picture: Looming cliff edges in pandemic support for workers. In the U.S., augmented unemployment insurance will expire in September, strengthening the incentive for millions of jobless to return to work. The U.K. furlough scheme that’s kept workers attached to their jobs also ends in September. A clear picture of labor-market conditions — and thus domestic inflationary pressure — won’t emerge until those distortions have been removed.

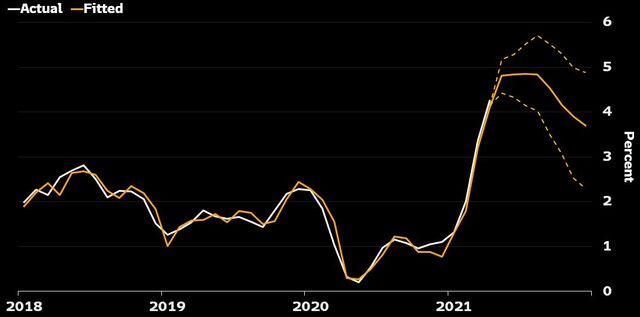

A Wide Band for U.S. CPI Forecast

Source: Bloomberg Economics. Note: Dashed lines are 70% uncertainty bands, drawn from the posterior distribution.

Underscoring the uncertainty, we used an old Ben Bernanke model to forecast the outlook for the U.S. CPI. The central forecast aligns with the consensus view of transitory price pressure. But — as the chart above shows — the 70% uncertainty band around the central forecast flags a distinct possibility: the CPI could still be close to 5% at year-end, considerably above market and Fed expectations.

Higher-than-expected readings for CPI gauges in the U.S. and elsewhere have prompted a shift in our central bank forecasts. We now see the U.S. making its first rate hike in 2023, not 2024, and we expect the BOE to move in 2022, not 2023. As a clearer picture of the trajectory for the recovery and inflation emerges, those forecasts could move again — more likely forward than back.