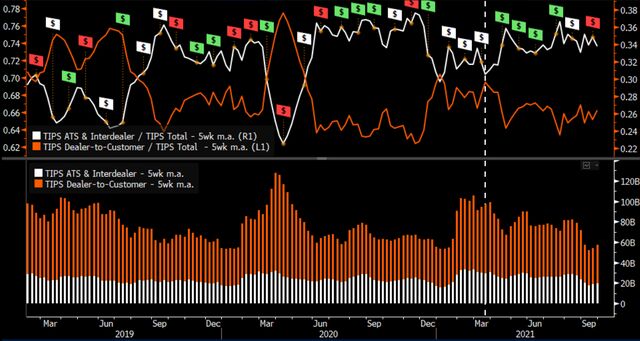

(Bloomberg Intelligence) — Inflation-traded markets have increasingly signaled acceptance of the Federal Reserve’s view that elevated inflation will prove fleeting. We believe shifts in realized inflation — as opposed to inflation expectations — will continue to drive allocations and hedging, while data surprises could lead to shifts in the share of trading on platforms vs. dealer-to-customer activity.

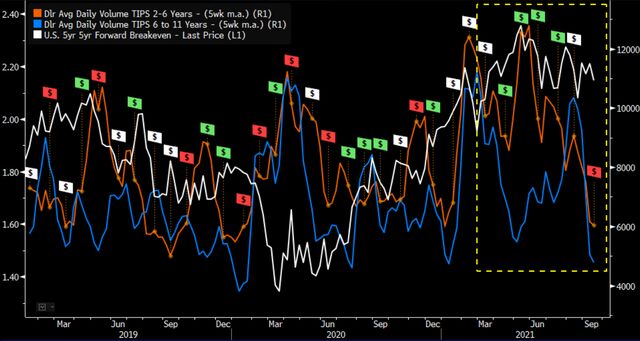

Primary Dealer Average Daily Volume in TIPS

Dealers’ diminishing average daily trading volume in TIPS provides support for the notion that investors may, in fact, be buying into the Fed’s view that inflation will prove transitory. When inflation prints heated up in the late spring and early summer — against the backdrop of rising inflation market-implied expectations — dealer volume in TIPS with 2-6 years to maturity soared to all-time highs. Volume in longer-dated TIPS, by contrast, collapsed. As inflation readouts cooled, but were still on- or slightly above-expectations, volume in the 2-6 year sector declined, while that in the 6-11 year sector picked up sharply.

The most recent below-expectations data has led volume in both sectors to decline toward levels typical of recent year-ends, suggesting investor concern over persistent inflation may be waning.

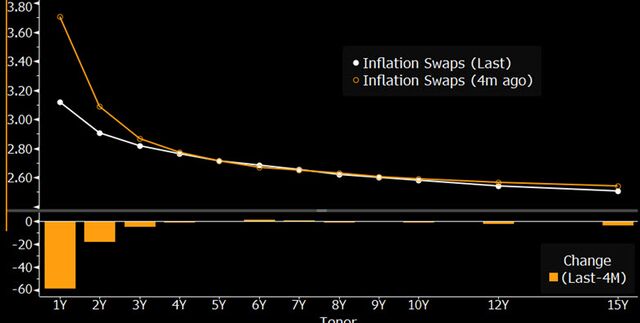

Market Expects Inflation to Slow

Though there may continue to be pockets of price increases on goods due to supply-chain issues, the peak growth may be in the rearview mirror, consistent with pricing on swaps tied to CPI. We generally agree with this assessment as the one-time shift higher in prices due to supply-chain issues isn’t likely to be repeated, yet we also suspect that elevated prices won’t fall in most sectors. For inflation to more generally rise and remain sustainable, wages in broad service sectors would have to climb regularly. The gain from minimum wages is a one-time shock that won’t last.

The market is pricing for CPI be just over 3% over the next year but fall to under 2.5% on a forward basis. If CPI near 2.5% remains the steady state, this suggests that real yields could stay negative for years to come.

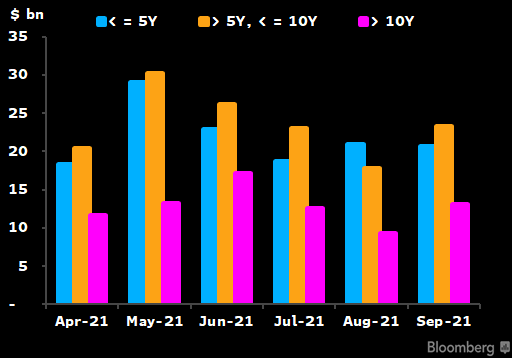

Inflation Swaps: Notional Volume by Tenor

Trading in inflation swaps closely tracked the data in the early spring and summer, with the notional amounts traded rising as data strongly beat expectations and declining as monthly prints cooled. Over the past two months, volume in nearer-dated swaps (five years or less) has stalled while that in intermediate- and longer-date swaps has risen. This is consistent with expectations that inflation in coming years will be transitory.

We expect activity in nearer-dated swaps, though still a significant portion of overall trading, to remain in a range as monthly prints continue to confirm the transitory view of the Fed. The modest rise in longer-dated swap trading in recent months coincided with the sharp decline in matched-maturity cash volume — suggesting some substitution — and the climb in 5-to-10-year real yields.