By Kamil Kowalcze

06/19/2025 07:30:00 [BN]

Summary by Bloomberg AI

- Europe risks stagnation due to slowing growth, weak investment, and rising geopolitical threats, according to the International Monetary Fund.

- The IMF calls for a “decisive push” to deepen the European Union’s single market, citing fragmentation across borders as a hindrance to innovation and corporate growth.

- The IMF warns of risks to the business environment and financial stability, and recommends increased investment and fiscal consolidation, as well as a 50% increase in the EU budget.

(Bloomberg) — Europe risks drifting into stagnation without urgent action to tackle slowing growth, weak investment and rising geopolitical threats, the International Monetary Fund warned.

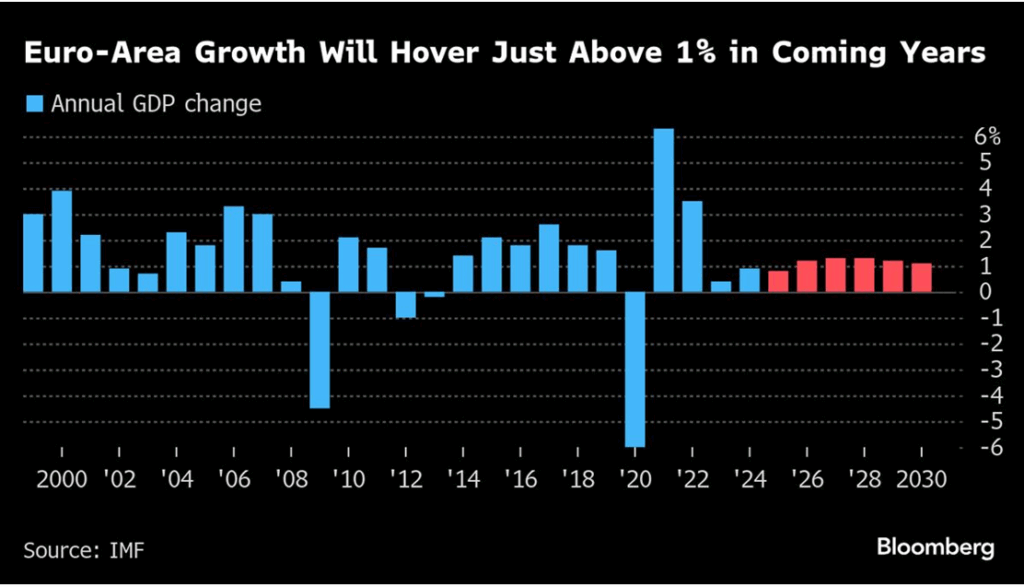

Trade tensions and low demand are choking momentum, with risks tilted sharply to the downside, the Washington-based institution said in a statement on Thursday. The euro area is expected to grow just 0.8% in 2025, despite record-low unemployment and inflation near target.

To revive productivity, the IMF called for a “decisive push” for a long-delayed deepening of the European Union’s single market, adding that fragmentation across borders is stifling innovation and corporate growth.

The cost to companies of existing barriers within the EU is equivalent to a 44% tariff on goods and 110% on services, the IMF said. Closing those gaps through regulatory harmonization, capital market reforms and labor mobility could boost gross domestic product by 3% over a decade, it added.

As defense, ageing, and climate costs push spending sharply higher, countries with fiscal space should invest, but highly indebted member states face painful consolidation, the IMF said. It called for a 50% increase in the EU budget to meet shared goals.

The fund sees risks of a worsening business environment for companies with exposure to the US, which could weigh on banks’ balance sheets. However, it described Europe’s banking system as “adequately capitalized and liquid” at the moment.

In its concluding statement after a so-called Article IV consultation, the IMF also warned that non-bank financial firms could threaten financial stability.