Karen Langley

The Wall Street Journal

September 10, 2023

Stock advances have surprised many investors, partly because expectations for company earnings hadn’t kept up.

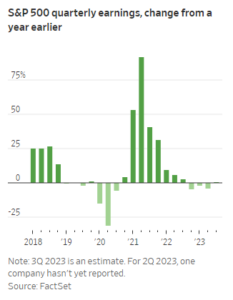

Wall Street expects corporate earnings to rebound after three quarters of year-over-year declines, a development that could put the stock market’s faltering rally on firmer footing.

When the next reporting season kicks off in earnest in October, analysts estimate that companies in the S&P 500 will show that profits inched up 0.5%, helping deliver a 1.2% increase for 2023, according to FactSet.

Climbing profits would be a welcome development after a period in which the stock market’s gains far outpaced anticipated profit growth. The S&P 500 has risen 16% this year, even after falling in four of the past six weeks.

“The real crucible test for the market is that we deliver positive earnings growth,” said Nancy Curtin, chief investment officer at the wealth and asset manager AlTi Tiedemann Global. “Not just less negative but positive.”

Yet some analysts said they think the market’s advance has already accounted for much of the improvement in earnings forecasts and caution that stocks still look expensive historically, even after the market’s recent stall.

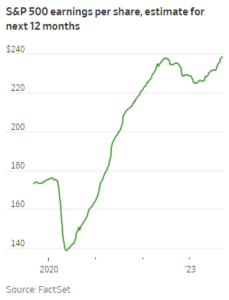

The S&P 500 is trading at 18.7 times its expected earnings over the next 12 months, above the 10-year average of 17.7 and up from 16.8 at the end of last year.

Analysts in recent days have also given their highest-ever estimates for per-share earnings from the industrials sector and the beaten-down utilities group. Industrials and utilities are up 7.1% and down 11% this year, respectively.

David Lefkowitz, head of U.S. equities at UBS Global Wealth Management, said he expects stocks to be rangebound through the end of the year, under pressure from the resumption of student-loan repayments as well as high energy prices and mortgage rates.

His team predicts that the S&P 500 will trade at 4500 in December and 4700 next June, up 1% and 5.4%, respectively, from Friday’s close.

“For the market to continue to move higher, you’re going to have to see those profit improvements likely continuing further out in time,” Lefkowitz said.

The optimism about earnings comes as investors and executives have grown more confident in the economy. Consumer spending and the job market have held up even as the Federal Reserve aggressively raised interest rates. Inflation was at a 3.2% annual level in July, down from a four-decade high of 9.1% in June 2022.

Investors will scrutinize the latest data on consumer-price inflation Wednesday and producer-price figures Thursday as they try to predict the Fed’s next moves. Traders are nearly sure central-bank officials will hold rates steady when they meet later this month, but they are assigning a 45% probability of at least one more increase by the end of the year, according to CME Group’s FedWatch tool.

Worries about the economy seem to be subsiding within big U.S. businesses. Sixty-two companies in the S&P 500 cited “recession” on earnings calls from June 15 through Aug. 31, down from 113 during the previous reporting period and well below the peak of 238 in the summer of 2022, according to FactSet.

“It’s like the most anticipated recession in modern history is not going to come,” said Jamie Cox, managing partner for Harris Financial Group.

The view that U.S. companies are going to make ever more money has kept many investors betting on stocks. Bank of America said in recent days that BofA equities clients had been net buyers of U.S. equities for five consecutive weeks.

“That is why you own equities: It’s to share in the profits of companies,” said Michael Rosen, chief investment officer at Angeles Investments. “That’s exactly what is happening. It’s why the markets are up and why we remain fully invested.”