Michelle Fox

CNBC

MAY 3, 2024

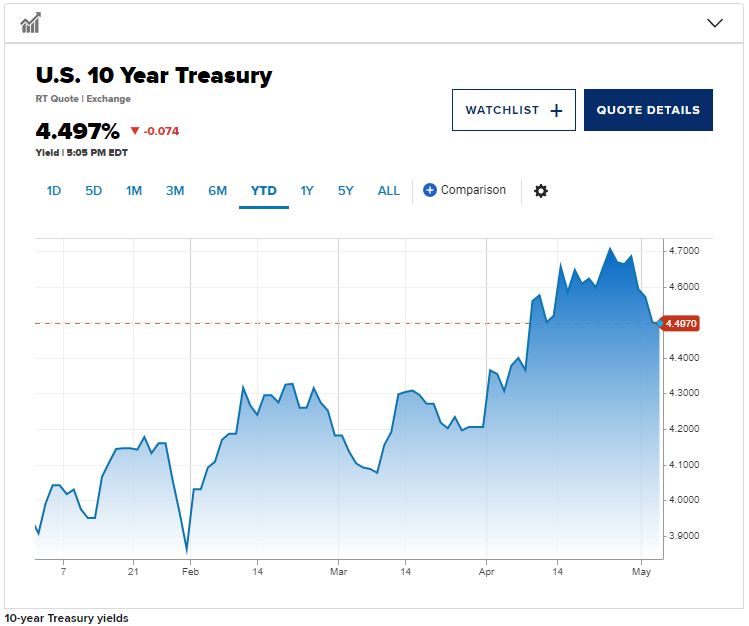

Yields are at levels not seen in 20 years, he pointed out. For instance, the Markit iBoxx USD Liquid Investment Grade Index was yielding 5.3% in March 2024, compared to 4.10% in March 2004 and 3.43% in March 2020, according to the report.

What investors shouldn’t do right now is try to time the market, especially since the Fed hasn’t historically given “the all-clear signal well in advance,” Laipply said.

“It is going to probably be impossible to call the peak in rates,” he added.

In fact, longer-term yields, such as the 5-year Treasury, have historically moved ahead of policy shifts, the report said.

“History tells us that investors can miss out on locking in higher yields if they wait for a clear, definitive answer on rate cuts,” the BlackRock report said.

Federal Reserve interest rate hikes have been on hold since July 2023. After this week’s Fed meeting, where it held rates steady, and Friday’s jobs report, traders are now pricing in two rate cuts by year-end, starting in September, according to the CME Group’s FedWatch tool.

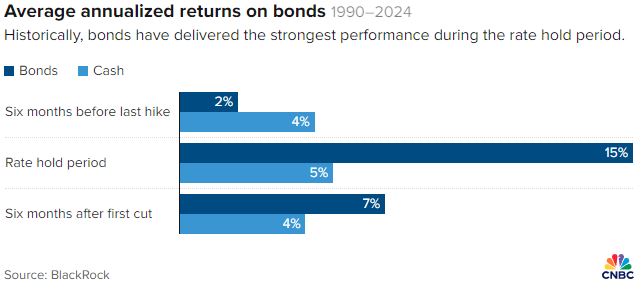

Bonds have historically delivered the strongest performance during “hold” periods, according to BlackRock.

In this cycle, bonds have had a slightly positive return since the Fed pause, Laipply said.

“It has been bumpier this time,” he said.

He suggests dollar cost averaging, or adding exposure over time, to boost your fixed-income allocation. In fact, many investors are currently significantly underweight to fixed income. They have just a 19% average allocation to the asset class, according to the BlackRock report, which analyzed Morningstar’s data of U.S. bond and money market exchange-traded funds and mutual fund assets as of Jan. 31.

“It is a very compelling opportunity for investors to get their fixed-income side of the portfolio right sized,” Laipply said.

Choosing individual bonds or bond funds comes down to an investor’s preference, he said. Using a bond fund or an ETF can allow an investor to get diversified exposure and do so more cheaply than buying individual issues.

BlackRock’s view is that investors should use a holistic approach, which can include a mix of both. Within funds, they can be both passive and actively managed, Laipply said.

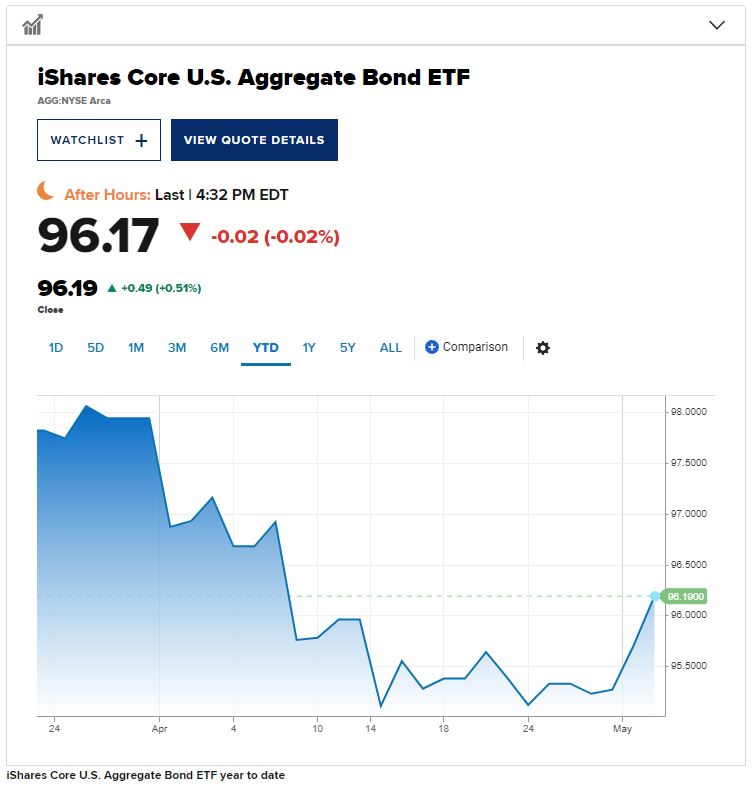

Right now, he thinks intermediate duration might be a good place to start. For those who want broad exposure to U.S. investment-grade bonds, BlackRock’s passively managed iShares Core U.S. Aggregate Bond ETF (AGG) tracks the Bloomberg U.S. Aggregate Index. It has a 30-day SEC yield of 4.81% and expense ratio of 0.03%. It has an effective duration of six years.

The iShares Core Total USD Bond Market ETF (IUSB) is also a passively managed, broad bond market fund which adds exposure to potentially higher-yielding names. It has a 30-day SEC yield of 5.12% and 0.06% expense ratio.

For an actively managed fund, BlackRock has its Flexible Income ETF (BINC). It has a 30-day SEC yield of 6% and a net expense ratio of 0.4%.