Updates - Monetary Policy

US REACT: Factory Output Flags Lower Goods Prices Ahead

Andrew Husby

Bloomberg

November 16, 2022

(Bloomberg Economics) —OUR TAKE: October industrial production figures add to a growing ensemble of data flagging softening core-goods inflation ahead, a plus for Fed officials looking to step down the pace of rate hikes. That said, with a tight labor market and robust services-price inflation accounting for the bulk of underlying momentum, the IP print isn’t a game-changer for the near-term policy outlook.

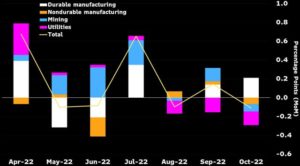

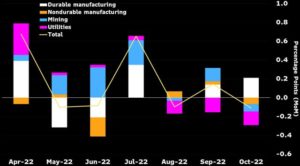

- Industrial production fell 0.1% in October, weaker than the consensus (0.1%) and Bloomberg Economics’ estimate for a 0.3% gain. Revisions to prior months softened the tone.

- Manufacturing output continued to grow (0.1% vs. 0.2% prior), with strength concentrated in vehicles and parts. Automakers assembled 10.7 million autos and light trucks at an annual rate, most since August 2020, and just about in line with pre-pandemic levels. That should help take some of the wind out of prices as higher interest rates restrain demand.

- Weakness in utility (-1.5%) and mining output (-0.4%) accounted for the bulk of the miss relative to consensus. Elsewhere, a dip in the production of construction supplies (-0.7%) isn’t a surprise given a plunge in residential building from high levels.

- Taken together, the slowdown in factory growth is consistent with an ISM survey output that hovered around 50 in October. That report pointed to reductions in order backlogs, less-lean customer inventories, better supply-chain performance, and lower prices.

The improvement in production is particularly apparent for big-ticket items like vehicles, where production since March has run at a faster clip than in 2019, before the pandemic. As inventories rise, prices for new and used cars are likely to ease, with the used-car market likely to see year-over-year price declines by year-end. Output of machinery and aerospace equipment also rose.

Looking ahead, there’s still a chance supply-chain disruptions re-intensify, but conditions are far different than they were last year when goods inflation started to surge. Stimulus has faded, interest rates have rocketed higher, and recession chatter is at a fever pitch. Barring another shock, that means the Fed will be much more attuned to labor-market developments and inflation expectations — which could serve as persistent sources of inflationary pressure — than they’ll be preoccupied with the extreme supply-demand imbalances that drove the initial inflationary wave.

November 16, 2022

Share This Story, Choose Your Platform!