Monday, January 29, 2024 02:56 PM

By Anna Wong (Economist), Nick Hallmark (Economist) and Ana Galvao (Economist)

(Bloomberg Economics) —

Bloomberg Economics’ new Fedspeak index, based on a natural language processing model trained on more than 60,000 Fed headlines, suggests the first rate cut will come in May. That’s later than market bets of March — but earlier than 2H24 as flagged in December’s Summary of Economic Projections.

Negative data surprises going forward could cause the Fedspeak index to quickly fall to a level consistent with a March move. Key words and phrases to watch for in upcoming communications are “uncertainties,” “risks,” and “global economic slowdown.”

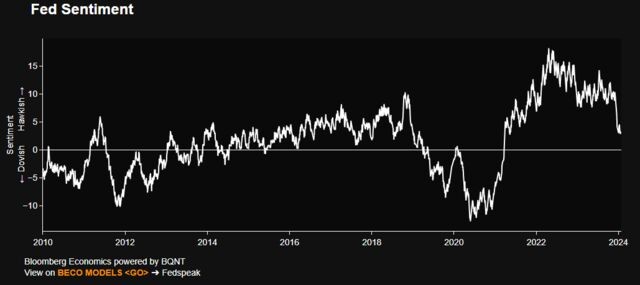

- Bloomberg Economics has developed a daily Fedspeak Index. The index is underpinned by an NLP algorithm trained on Bloomberg News headlines, covering about 6,200 speaking engagements by Fed officials since 2009. The index is available at BECO MODELS <GO> -> Fedspeak.

- The model is trained to mimic our reading of Fed communications. A reading below zero typically implies imminent rate cuts, while a reading above zero indicates a tightening basis. In December, the reading was around the same level seen at the time of Fed Chair Jerome Powell’s dovish pivot in January 2019 — helping us predict his dovish turn last month.

- The current reading – which takes into account officials’ speeches since the Dec. 12-13 FOMC meeting — suggests Fed communications retain a slight tightening bias overall. Still, the index has been falling sharply and is now at a level similar to March 2019, four months before the Fed cut rates. Extrapolated to the current context, that implies an initial rate cut this May — later than current market pricing or our house view.

- Our Fedspeak model broadly tracks with the Fed minutes model developed by our rates strategy colleagues at Bloomberg Intelligence.

BE Fedspeak Index on Par With Level 4 Months Before July 2019 Cut

Source: Federal Reserve, Bloomberg Economics

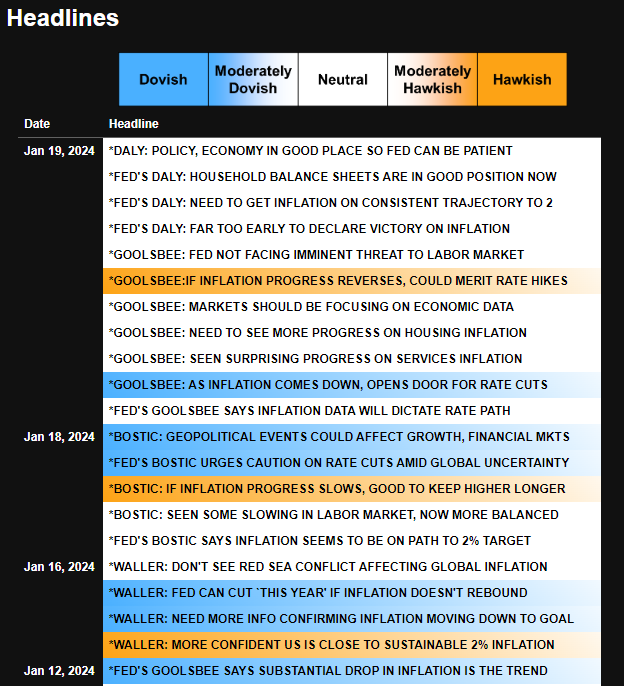

- The Fedspeak tool on the terminal allows users to look at the Bloomberg headlines that are driving the scoring. A few themes in the Fedspeak four months before the 2019 July rate cut echo what we see today:

- Strong US economy:

- Powell on March, 20, 2019: “US economy is in good place, want to keep it there.”

- Powell the same day: “Growth to be solid in 2019, though slower than 2018.”

- Headwinds to global growth:

- Powell again on March 20, 2019: “Weaker global growth can be a headwind to US.”

- Minneapolis Fed President Neel Kashkari, March 5, 2019: “China slowing down quite a lot, trade also a risk.”

- Several Fed officials still warn of wage pressures, possibility of hikes:

- Powell on March 20, 2019: “Many other labor indicators show strength.”

- Boston Fed President Eric Rosengren on March 5, 2019: “Hike should be on table if economy meets his outlook.”

- Strong US economy:

Latest Fedspeak Headlines and Model Scoring

Source: Federal Reserve, Bloomberg Economics

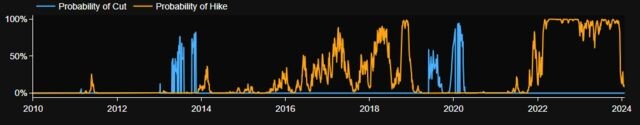

- We calculated the probabilities for rate cuts vs. hikes implied by Fedspeak, using a regime-switching probit model that controls for economic-data surprises. According to the current reading, the probability of rate hikes has plunged since December, and is now approaching zero. However, the threshold for rate cuts hasn’t yet been crossed – in the 2019 episode, cuts began two months after this was triggered.

Fedspeak-Implied Probability of Rate Hikes Falling Toward Zero

Source: Federal Reserve, Bloomberg Economics

- Looking forward, the Fedspeak Index will serve as an important – and objective — tool to ground our Fed analysis. Historical experience, particularly the 2019 episode, shows the index can fall rapidly, triggering our regime-shift probability model for imminent rate cuts.

- For example, we note headlines a month or two before the July 2019 rate cut that still characterized the economy as very strong. However, there also were headlines that flagged an imminent policy recalibration, particularly from then-Vice Chair Richard Clarida.

- Clarida on May 30, 2019: “US inflation has been coming in lower than expected.”

- Clarida again on May 30: “Global economy outlook marked down versus last fall.”

- New York Fed President John Williams on May 31, 2019: “Crisis showed fast rate cuts needed in steep downturn.”

- San Francisco Fed President Mary Daly on June 3, 2019: “Economy is in really good place.”

- Richmond Fed President Thomas Barkin on June 3, 2019: “Hot economy, job gains pulling workers from sidelines,” but also, “Barkin says he’s nervous about global economy, cites Europe.”

- St. Louis Fed President James Bullard on June 3, 2019: “Rate cut may be warranted soon to lift inflation,” “rate cut may also give insurance on economy slowdown.”

Bottom line: Words matter — and our new Fedspeak Index demonstrates that FOMC communications can be an important tool in identifying imminent policy changes. This new tool allows us to monitor the shifts in Fed rhetoric as the FOMC considers rate cuts. The current reading suggests cuts may come later than the market expects — but earlier than FOMC members themselves penciled in last month.

Methodology — Fedspeak Index

The Fedspeak Index is an NLP index that aims to quantify the Fed’s communication sentiment. We employ a RoBERTa-based machine-learning model, fine-tuned and trained on thousands of human-labeled annotations of Bloomberg reporting of Fed officials’ communications, set to mimic our chief US economist’s interpretation of the text. The sample covers more than 6,200 unique speaking engagements and statements made by FOMC members since 2009, totaling more than 60,000 Bloomberg News headlines labeled as “Fedspeak.” After filtering the headlines for relevancy, the NLP algorithm was applied to about 47,000 relevant headlines.

The process for creating the daily Fedspeak sentiment index begins with the aggregation of individual headline scores. Each headline is assigned a sentiment score using the model, ranging from -2 (highly dovish) to +2 (highly hawkish). For a given day, the model takes the sum of all scores attached to headlines labeled with the NI code “FEDSPEAK.” The raw sentiment score for each day is then scaled by the sum of the absolute values of all scores for that day. This results in a raw daily sentiment score that represents the combined sentiment of all Fedspeak communicated on that day. A reading above zero is trained to reflect a tightening bias, and below zero as accommodative bias.

To predict the probability of a hike/cut in the federal fund rate target at the next FOMC meeting, we employ a regime-switching probit model. Depending on whether we’re in a loosening or tightening policy stance, the predictions will switch between the probability of a cut or the probability of a hike.

The monetary-policy stance is defined endogenously based on how the previous Fedspeak indexes compare to a threshold. The threshold and the impact coefficients are estimated using Fed rate decisions in FOMC meetings from 2009-2023, as well as previous-day observations of both the monetary policy surprise and economic surprise indexes.

The model is flexible enough to allow the contribution of the Fedspeak indexes to the policy decision to change with the policy stance, and for contributions from data and policy communication to have different weights.