- Market is pricing a recession, but it’s not inevitable: Kostin

- Other strategists see stock slump as only just beginning

(Bloomberg) —

Doom and gloom on the outlook for the US economy and its stock market may have gone too far, according to some top Wall Street strategists.

Goldman Sachs Group Inc.’s David J. Kostin and JPMorgan Chase & Co.’s Marko Kolanovic say investor fears of imminent recession in the US are overblown — leaving room for an equities recovery as the year progresses, in Kolanovic’s view. The benchmark S&P 500 has slumped 18% from its January record, approaching bear market territory.

JPMorgan’s Kolanovic Says Stocks ‘Can Climb Out of This Hole’

“A recession is not inevitable,” Goldman strategists led by Kostin wrote in a note on May 18. “Rotations within the US equity market indicate that investors are pricing elevated odds of a downturn compared with the strength of recent economic data,” he said.

The relative performance of cyclical and defensive stocks suggests a “dramatic growth slowdown,” which isn’t supported by ISM Manufacturing data, Kostin wrote. Goldman’s economists see a 35% probability that the US economy will enter a recession during the next two years, he said.

US equities have slumped this year as signs of stubbornly high inflation and a hawkish Federal Reserve raise the specter of an economic downturn. Concerns about stagflation have risen to the highest since 2008, prompting investors to hoard cash and turn underweight on equities, according to Bank of America Corp.’s latest fund manager survey.

Cash Hoarding at 2001 High on Stagflation Fear, BofA Poll Shows

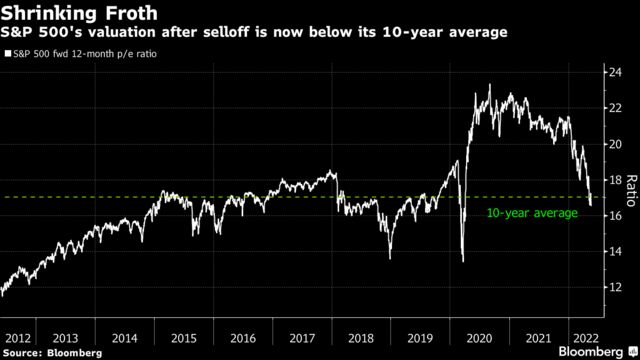

And the froth is starting to come off the US market. The S&P 500 now trades at 16.5 times estimated 12-month earnings, the lowest since April 2020 and below the average of 17.04 times seen over the past decade.

JPMorgan’s Kolanovic said in an interview last week that things will get better for US stocks, and he doesn’t expect a recession this year due to “some summer increase in consumer activity on the back of reopening and China increasing monetary and fiscal measures.”

His views on recession have been echoed by Kate Moore at BlackRock Inc. and Michael Wilson at Morgan Stanley.

Credit Suisse Group AG also agrees. “Investors should not sell into the market lows in a panic,” Michael Strobaek, the firm’s global chief investment officer, wrote in a note today. “Once real yields peak, there is potential for a rapid rebound.” Equity markets in particular have recovery potential, he said.

More Declines

Some strategists are less sanguine, and see further downside for stocks as central banks turn off the monetary taps that have powered their bull run over much of the past decade.

HSBC Holdings Plc strategists including Max Kettner slashed their year-end target for the S&P 500 by 9.2% to 4,450 points today due to the risk of a severe slowdown in growth. Deutsche Bank’s Binky Chadha, who had the second-highest year-end target for the benchmark among strategists tracked by Bloomberg, also cut his forecast.

Global Market Downturn Only Just Beginning for Some Strategists

“Financial conditions are only starting to tighten,” said Charu Chanana, market strategist at Saxo Capital Markets Pte. “Markets are still digesting all the nuances of the complex of pandemic, supply issues and inflation — and now with risks of stagflation in the picture — I think we are only getting started!”