Contributing Analysts Ashley Kim (Technology)

(Bloomberg Intelligence) — Recent earnings suggest that tech investors are focusing more on future profit than sales gains, which could lead to multiple expansion for leading cash flow generators like Apple, Microsoft and Alphabet in 2022. Alternatively, high-growth companies like Shopify and Snowflake may be punished more severely — like Netflix and Meta — than in the past if they show even a hint of sales or profit slowdown.

Amazon 1Q Sales Guidance

Amazon.com’s stock jumped 13.5% following its 4Q earnings report Feb. 3, despite a weak sales-growth outlook, driven solely by the potential for robust operating profit. This was due to strong revenue in its higher-margin cloud unit and a slowing pace of new investments. Guidance for 1Q sales growth was just 3-8%, well below consensus of an 11% gain. In other times, this dour sales view could have dragged down the post-earnings stock price.

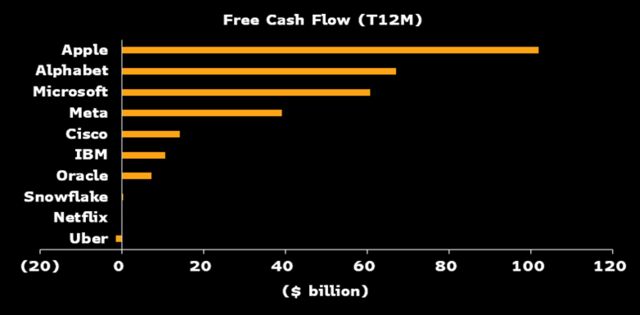

This leads us to believe that big-tech investors may be focusing more on potential free cash flow growth than they were the past few years, when sales expansion was seen to be more crucial. This change in sentiment could mean that cash flow-rich names like Apple, Microsoft and Alphabet see even more attention compared with other companies.

Trailing 12M Free Cash Flow

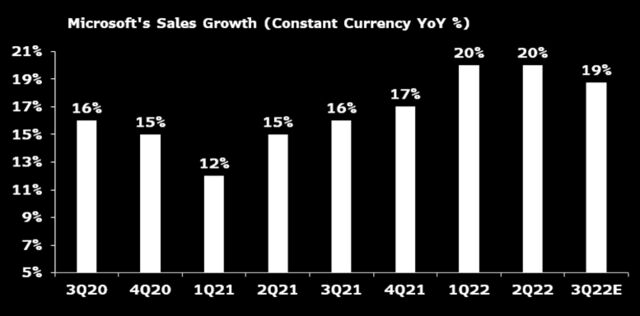

Microsoft is, like Apple, a strong cash generator, has a solid balance sheet and trades at a reasonable multiple compared with pre-pandemic levels and other mega-cap technology companies. We believe that it’s also one of the few companies in the tech sector that could continue to produce double-digit sales growth over the next three years even if the global economy goes into a recession. For the next 12 months, Microsoft sales could expand 15-20%, or 1.5-2x faster than the overall software market. This is commendable, given that the company represents over one-third of the entire software industry’s sales.

Shopify’s Best Price-to-Sales (x)