Steve Matthews

Bloomberg

September 6, 2023

- Resilience may lead to fewer rate cuts penciled in for 2024

- Separate tracker from Atlanta Fed is at 5.6% for third quarter

The US economy has been looking so solid lately that Federal Reserve officials will probably need to double their projection for growth in 2023 when they publish an updated outlook later this month.

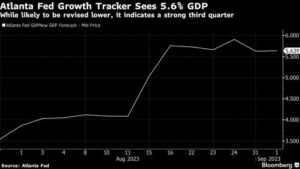

Following a string of stronger-than-expected reports on everything from consumer spending to residential investment, economists have been boosting their forecasts for gross domestic product. One widely-followed, unofficial estimate produced by the Atlanta Fed even has it expanding 5.6% on an annualized basis in the third quarter.

That marks a sharp turnaround from three months ago — the last time policymakers updated their own numbers — when the consensus viewwas that the economy would stall in the current quarter. And it may be enough to prompt Fed officials to scale back their estimates for interest-rate cuts in 2024.

“Consumer spending was robust in June and July, so the third quarter is virtually baked in the cake at this point,” said Stephen Stanley, the chief economist at Santander Capital Markets US who is projecting 3.7% growth in the July-to-September period. “5% seems too high, but not impossible.”

Any read on GDP growth above 3.2% would mark the strongest quarter since 2021, when the US was experiencing a rapid recovery from the initial shock of the pandemic. The acceleration is in stark contrast with the outlook for China, which has been downgraded in recent weeks amid a mounting property crisis.

When Fed officials last updated their own projections for the US in mid-June, they showed the median policymaker thought GDP would expand just 1% in 2023. At the time, that marked an upgrade over the previous projection round in March, which implied a recession this year.

That number will probably go up to 1.8% or 2% in the new projections set to be released at the conclusion of the central bank’s Sept. 19-20 policy meeting, and the outlook for the unemployment rate could be revised lower, according to Omair Sharif, president of Inflation Insights LLC.

The growth upgrade may also lead Fed officials to scale back the easing they had projected for next year to 75 basis points of rate cuts instead of 100, Sharif said.

Widespread Upswing

The Atlanta Fed tracker — which is separate from policymakers’ quarterly projections — is volatile and will probably be revised down some before the government publishes its first official read on current-quarter growth at the end of October.

But it underscores the widespread upswing in sentiment over the past few months. Better-than-expected numbers in a monthly Institute for Supply Management report on the US services sector published Wednesday bolstered the theme.

Despite the rising optimism, the central bank has signaled it will probably leave its benchmark interest rate unchanged at the September meeting.

A rate hike in July brought it into a range of 5.25% to 5.5% — the highest level in 22 years — and Fed Governor Christopher Waller said Tuesday that policymakers can now afford to “proceed carefully” given recent data showing inflation continues to ease. On Wednesday, Boston Fed President Susan Collins cautioned further tightening could yet be warranted.

“The economy accelerated over the summer, but the Fed is willing to wait out September,” said Diane Swonk, the chief economist at KPMG LLP in Chicago. “A soft or ‘softish’ landing is now the most likely scenario.”

Even if the odds of a recession have come down, forecasters are largely sticking to predictions that growth will slow in the fourth quarter. Looming headwinds include rising gasoline prices, a resumption of student-loan payments and the possibility of a government shutdown.

What Bloomberg Economics Says…

“We don’t see the likely strength in 3Q GDP as indicative of increased probability of soft landing; to the contrary, in our view that actually increases the chance of a negative GDP print in 4Q. … With no comparable forces in the horizon in 4Q, student loan payments resuming, consumer loan delinquency rising and the labor market softening, consumption will likely be weak in 4Q.”

— Anna Wong, chief US economist

Many also believe the impact of aggressive rate hikes over the past year-and-a-half, and tighter credit conditions in the wake of bank failures earlier this year, will soon begin to show.

“The end of the three-year student forbearance program is likely to exert some drag on consumer spending as over 27 million borrowers will need to start making monthly loan repayments,” said Thomas Feltmate, a senior economist at TD Bank Group.

“I suspect we’ll also see some of the air on business investment come out over the coming quarters — particularly with rates having turned higher in recent months — and credit conditions remain quite tight.”