Friday, May 28, 2021 06:38 AM

(Bloomberg) —

This month’s drop in yields was supposed to benefit high-growth tech names. Not only didn’t they rise — they fell, now headed for the biggest loss since October.

- And while a list of reasons why that could’ve happened is getting long, one take is that it’s because a rates argument — which holds that higher yields make longer-duration assets less attractive, and vice versa — loses its top spot in terms of importance to relative profit growth. Even if rates continue to falter, investors will still opt for sectors where profits are roaring back the most.

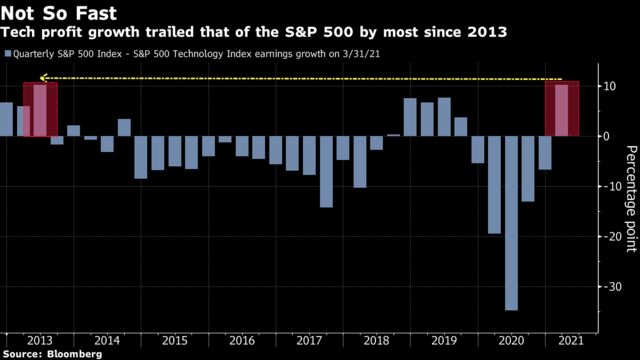

- The view, expressed by Deutsche Bank strategists, is finding evidence in the earnings season that just wound down. The tech sector reported 44% profit growth, data compiled by Bloomberg show, but a bigger deal for Wall Street was that the corresponding figure for the S&P 500 was higher for the first time since 2019. The gap, at 10 percentage points, is the biggest since 2013, and is only expected to get bigger in the next couple of months, reaching the widest level since 2009 by the time the second-quarter season starts, data compiled by Bloomberg show.

- The Nasdaq 100 Index has lost 1.5% this month through Thursday, while the yield on the 10-year note is down 2 basis points during the same time. Higher-growth, long-duration assets are some of the most sensitive to changes in interest rates, perhaps helping explain why a negative correlation between tech shares and the 10-year Treasury yield has hovered near 0.7 over the past 12 months. But oscillations in yields are becoming less important for traders when entire sectors of the market tied to the economy are expected to make a turnaround.

- “Beyond the discount rate, equity valuations depend critically on long-run earnings growth expectations,” said Binky Chadha, Deutsche Bank’s chief global strategist. “This is even more so for Growth stocks which typically grow earnings around 6.6pp faster than the rest of the S&P 500 annually. The pandemic benefited relative earnings prospects for Growth stocks; and the cyclical recovery is now benefiting relative earnings for the rest of the S&P 500.”

- Futures on the S&P 500 are up 0.3% on the last session of the month, as Nasdaq 100 futures are up 0.1% premarket and small caps are little changed. The S&P 500 Index is finishing the month trading in the range between 4,056 and 4,238, where it has traded since the beginning of April. It will be interesting to see if a number of events next week, from Janet Yellen’s speech at the G-7 meeting to an OPEC+ event, to ISM Manufacturing data will finally change that.

Notes From the Sell Side:

- Apple was downgraded to sell at New Street Research, which cited a weaker outlook for the iPhone following strength last year. “The key question is how things shape up for next year, as the current super-cycle has brought forward demand, the next iPhone line up is likely a “12S” type with limited innovation, and consumers spend less on consumer electronics as the economy re-opens.” The firm sees “material downside risk” to shipments.