By Emily Herbert

8/6/2025

Trump’s tariffs and strong currency weigh on Eurozone corporates

European companies are falling behind their US counterparts in their second-quarter earnings, as the impact of President Donald Trump’s trade war frustrates investors who had bet heavily on a revival for the region’s stock markets.

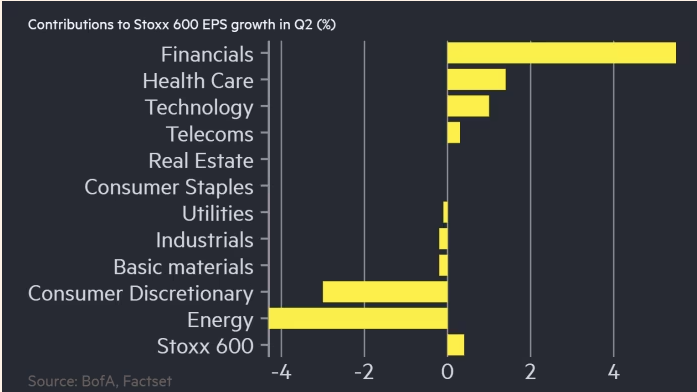

With more than half of the companies in the Stoxx Europe 600 having reported earnings, the index is on track for no earnings growth compared with a year ago, according to Bank of America, sapping optimism over a revival in the region’s equity markets.

By contrast, the S&P 500 index’s constituents are on track to post 9 per cent year-on-year average earnings growth, according to BofA, powered largely by strong results from Silicon Valley’s tech giants and Wall Street banks.

Grant Bowers, senior vice-president at investment firm Franklin Templeton, said: “Earlier this year, there was this narrative shift that the US was going to lose its exceptionalism brand and the rest of the world would catch up.

“But the reality is, you have to back it up with earnings and profits and economic growth. You need the corporations to follow through — and Europe struggles to have these leading businesses.”

In Europe, barely half of the companies to report earnings have beaten analysts’ expectations, according to BofA. But the S&P 500 was on course to record one of the largest number of positive surprises relative to expectations for 25 years — exceeded only during the coronavirus pandemic era, Goldman Sachs analysts said.

European stocks outpaced their Wall Street peers at the beginning of this year, after years of underperformance, as investors’ long-standing faith in US equities was shaken by Trump’s unpredictable policymaking.

Many investors bet Germany’s “whatever it takes” fiscal stimulus package and an enormous uplift in European defence spending would drive a prolonged upturn in the region’s equity markets. A BofA survey of fund managers showed allocations to Eurozone stocks leapt to their highest level since 2021 at the beginning of this year.

But the outperformance was shortlived. Strong earnings from the US mega caps have sent Wall Street stocks powering ahead again, despite Trump’s tariff onslaught and deteriorating US economic data. Weak second-quarter earnings in Europe have supported the growing view that the region’s stock rally is losing momentum.

“No one expected a good season in Europe,” said Andreas Bruckner, investment strategist at BofA. “The bar was quite low but, excluding financials, they still missed that bar.”

With analysts’ forecasts having been lowered because of the trade war, companies on both sides of the Atlantic that beat expectations were rewarded less than usual in terms of a share price bump. Meanwhile, companies that missed expectations were punished harshly, according to Goldman Sachs data.

For Europe, this earnings season looks like a return to the status quo, according to Bruckner, of “inferior earnings growth and European underperformance”.

While the S&P 500 has repeatedly hit new records since Trump’s so-called liberation day on April 2, European shares are virtually flat, with the Stoxx Europe 600 index yet to return to its early March peak, although some areas of the market, such as airlines, have outperformed the US this year.

Exporters bore the brunt of Europe’s earnings disappointments, with carmakers having the most cuts to their 2025 earnings forecasts of any sector. Volkswagen, Stellantis and Mercedes-Benz all issued warnings about the effects of Trump’s tariffs.

But financial companies in Europe have continued to resoundingly beat expectations. Results from Deutsche Bank, UBS and BNP Paribas surpassed forecasts, driven by strong performances from their trading businesses.

Meanwhile, the strong S&P 500 earnings growth “is almost completely driven by tech”, said Sharon Bell, senior equities strategist at Goldman Sachs. “Europe almost has none of that dynamic.”

Currency effects have been a big drag for European exporters, with the euro rising about 12 per cent against the dollar this year as investors shunned US assets. While that has benefited non-euro investors who allocated to the bloc’s stocks, an analysis of earnings transcripts by Barclays showed more than 80 per cent of Stoxx 600 companies cited currency moves as weighing on their earnings.

“The euro being stronger has been a big headwind for European companies, because so many make dollar earnings,” said Bell, adding this may continue to prove a challenge. “We feel that the euro can continue to rise. The dollar still looks overvalued.”

Recommended Business InsightRichard Milne European business has shown surprising resilience The cheaper greenback has been a boost to earnings of US exporters when overseas revenues are translated back into dollar terms.

Uncertainty arising from Trump’s sweeping new tariff regime has also been a challenge for Europe’s exporters this year, although analysis by Barclays showed currency moves had a bigger impact.

The direct tariff impact for European companies was “extremely small”, said Bell, as groups can work through inventories they built up before the levies came into effect.

Bell said the true impact would only be known in the second half of this year