By Maria Eloisa Capurro and Dana Morgan

09/12/2025 03:00:00 [BN]

Summary by Bloomberg AI

- Economists surveyed by Bloomberg News expect the Federal Reserve to execute a series of interest-rate cuts in the coming months, beginning with a reduction next week.

- The median respondent sees two cuts by year’s end, but a sizable minority anticipates three reductions, with investors leaning more heavily in the direction of three rate cuts this year.

- Almost 90% of respondents also expect Fed officials will change their post-meeting statement to emphasize greater attention to labor-market risks, with the new statement to be released on Sept 17.

(Bloomberg) — Cracks in the job market will likely prompt the Federal Reserve to execute a series of interest-rate cuts in the coming months, beginning with a reduction next week, according to economists surveyed by Bloomberg News.

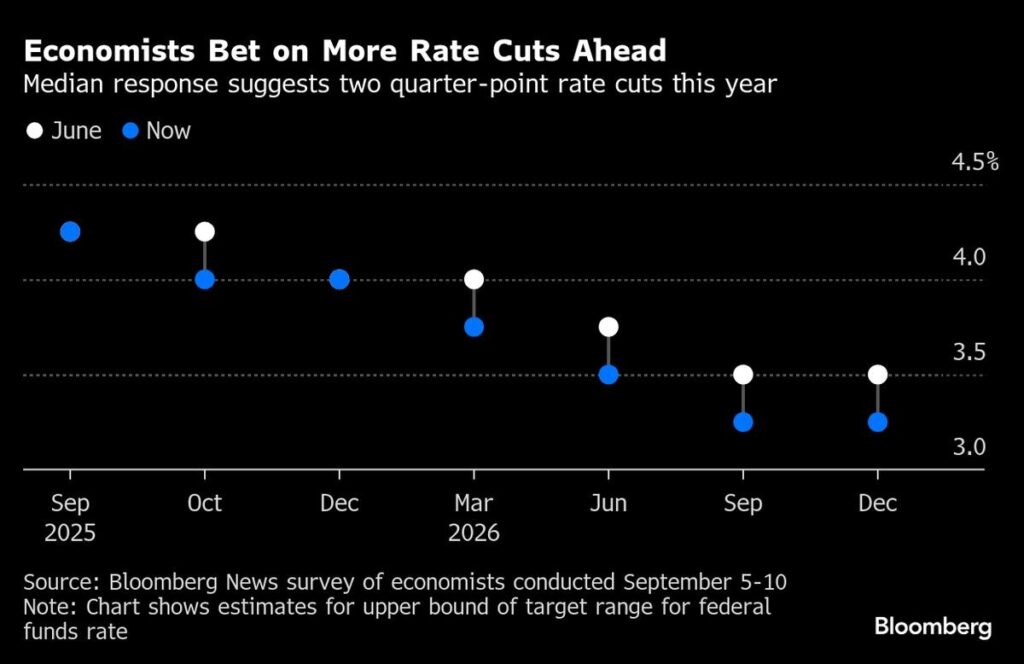

The median respondent sees two cuts by year’s end, but a sizable minority — more than 40% — anticipates three reductions. Of those anticipating two moves, economists were almost evenly split over whether a second cut would come in October or December.

Investors are leaning more heavily in the direction of three rate cuts this year, with federal funds futures almost fully pricing in that scenario.

Almost 90% of respondents also expect Fed officials will change their post-meeting statement to emphasize greater attention to labor-market risks. The new statement will be released on Sept. 17 at 2 p.m. in Washington, with Chair Jerome Powell scheduled to hold a press conference 30 minutes later.

“The balance of risks surrounding the Fed’s dual mandate of price stability and maximum employment are swinging toward one, whereby the jobs market is the bigger concern,” James Knightley, chief international economist at ING, wrote in comments submitted with his responses.

The FOMC said after its July gathering that the labor market was still “solid,” but the latest economic data have challenged that view. The unemployment rate ticked up to 4.3% in August, and revisions pointed to a sharp slowdown in hiring in recent months. Last week, average monthly job growth in the year through March was also revised down by roughly half.

Powell opened the door to a rate cut during a speech in Jackson Hole, Wyoming in August, when he said a “shifting balance of risks” could warrant intervention by the central bank to prevent rising unemployment.

By June 2026, respondents see the upper bound of the target range for the federal funds rate at 3.5%, a full percentage point below where it is now.

A large majority said the central bank faces upside risks to both unemployment and inflation, according to the survey, which was conducted Sept. 5-10. Still, only two of 42 respondents predicted a recession in the next 12 months.

More Dissents

Economists expect Chair Powell will face a fractured committee next week, with dissents possible on both sides of the anticipated quarter-point cut. Large minorities see Governors Michelle Bowman and Christopher Waller dissenting again, this time in favor of a half-point reduction. Both voted in favor of a quarter-point cut in July when the FOMC left rates unchanged.

A similar number of respondents expected Stephen Miran, chair of the White House Council of Economic Advisers, will also dissent in favor of a larger reduction should he be confirmed by the Senate and sworn in as a Fed governor in time for the meeting.

On the opposite end, Kansas City Fed President Jeff Schmid is seen as the most likely to vote in favor of holding rates steady.

Political Risks

President Donald Trump has amplified his demand that the Fed lower rates by as much as 3 percentage points, just as he considers candidates to lead the central bank next year. He’s also sought to fire Governor Lisa Cook, who is fighting her dismissal in court. A judge ruled this week she can remain in her post as litigation continues. The administration has appealed that decision.

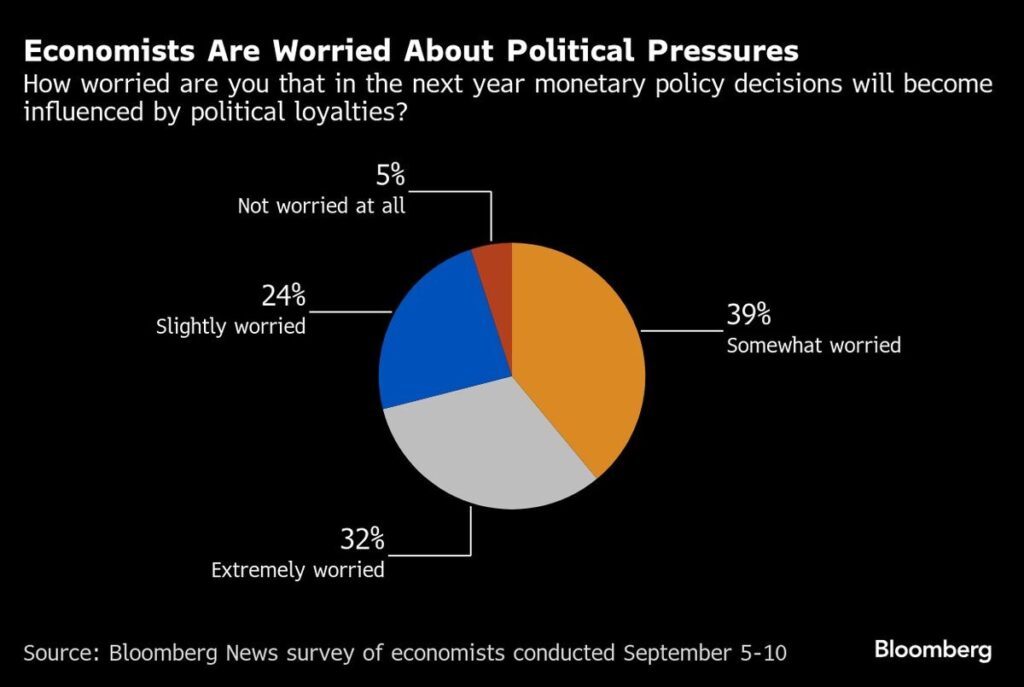

Against that backdrop, 71% of survey respondents said they were “somewhat” or “extremely” worried that monetary policy decisions in the next year will become influenced by political loyalties. Asked specifically about the Cook case, a narrow majority said it would significantly undermine the Fed’s independence if Trump succeeds in firing her.

Yet the reaction to those threats in financial markets has been mostly muted. The yield on 10-year Treasury notes has moved down in recent months and market-based measures of expected inflation remain steady. Bond yields and inflation would move up if investors doubted the Fed’s commitment to price stability.

Slightly more than half of the economists said investors were underestimating the political threat to the Fed’s independence.

“Executive branch pressure to ease monetary policy during a period when inflationary pressures are building is coming perilously close to unleashing stagflation,” wrote Tom Fullerton, an economics professor at the University of Texas at El Paso, referring to a scenario in which growth stagnates and inflation runs high.