Summary by Bloomberg AI

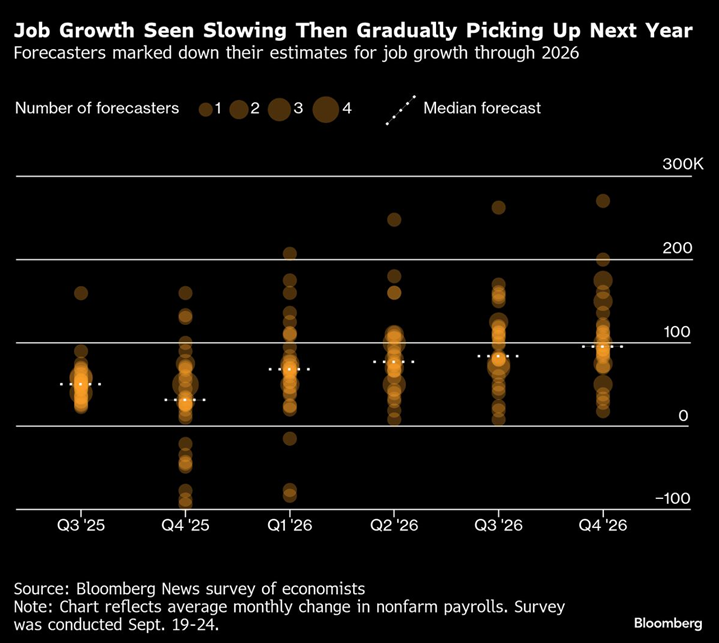

- Economists downgraded their projections for US job growth through the end of next year, citing an average of 71,000 payrolls rising a month from the fourth quarter of this year through 2026.

- The more subdued pace of job creation will encourage US central bankers to gradually lower borrowing costs, culminating with reductions totaling a percentage point by September of next year.

- Economists expect job growth to slow through the end of this year before gradually improving next year, with growth expected to average less than 2% next year as the slowdown in the labor market restrains households.

By Julia Fanzeres and Dana Morgan

09/26/2025 05:00:00 [BN]

(Bloomberg) — Economists downgraded their projections for US job growth through the end of next year, helping explain why the Federal Reserve is expected continue to lower interest rates.

Payrolls will rise an average 71,000 a month from the fourth quarter of this year through 2026, according to the latest Bloomberg monthly survey of economists. That is 20,000 less than forecasters were anticipating last month.

The more subdued pace of job creation will encourage US central bankers to gradually lower borrowing costs, culminating with reductions totaling a percentage point by September of next year, according to the survey.

Last week, the Fed lowered its benchmark rate for the first time this year. Fed Chair Jerome Powell pointed to growing concerns about the labor market as a reason for the reduction, adding the market could no longer be described as “very solid.”

“We continue to expect the weak labor market, job losses, and weak consumer spending on services to outweigh the impacts that tariffs are having on goods, leading to multiple Fed cuts to end 2025 and to start 2026,” said Luke Tilley, chief economist at Wilmington Trust Corp.

Economists expect job growth to slow through the end of this year before gradually improving next year.

Forecasters expect core inflation — measured by the personal consumption expenditures price index minus food and energy — to peak at an average of 3.2% in the fourth quarter and to then only gradually ease in the second half of 2026.

Bloomberg’s survey of 80 economists was conducted Sept. 19-24. It also showed economic growth will cool over the last three months of this year. They see gross domestic product rising at a 1.2% annual pace in the fourth quarter before activity gradually accelerates in 2026.

Still, growth is expected to average less than 2% next year as the slowdown in the labor market restrains households.

The Bureau of Economic Analysis reported yesterday that the economy grew in the second quarter at the fastest pace in nearly two years, bolstered by resilient consumer spending and business investment