Rita Nazareth

Bloomberg

1/17/2024

- Fed swaps trim odds of March interest-rate cut to about 50%

- US retail sales rise by most in three months to cap holidays

Stocks joined losses in risk assets as bond yields climbed on speculation the Federal Reserve will be in no rush to cut interest rates as the economy shows signs of resilience.

At a time when good economic news is not really that great from a policy perspective, a solid reading on retail sales fueled concern about Wall Street’s bold dovish bid. And with central bank officials recently striking a more cautious toneabout prospects for easing, it ended up being the perfect recipe for traders to push back the timing for the first Fed move — assigning lower odds of a rate reduction in the first quarter.

“We will need to see data that is consistent with a still healthy and resilient consumer, but not to the point where the Fed would be inclined to delay rate cuts or cut less in 2024,” said Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter.

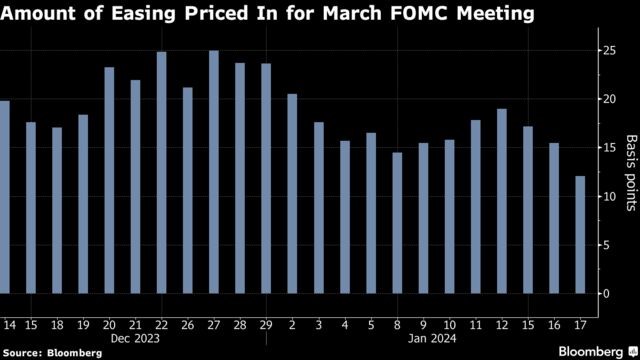

Resilient consumer spending helped propel the economy in recent weeks, the Fed said in its Beige Book survey. Fed swaps now show the probability of easing as soon as March dropping to around 50% — compared with 80% on Friday. The move also reflected a slide in UK bonds after data showed inflation picked up — making traders pare their bets on Bank of England easing.

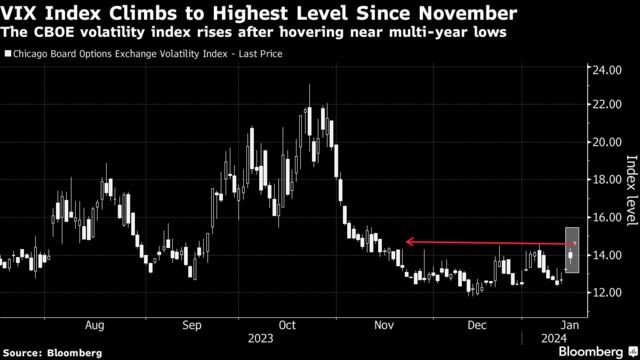

Treasury two-year yields approached 4.4%. The dollar rose. The S&P 500 was set for the biggest drop in about a month. Wall Street’s “fear gauge” — the VIX — hit the highest since November. The MSCI Emerging Markets Index of stocks slid 2%, with the risk-off tone also sinking oil.

US retail sales rose at the strongest pace in three months in December, capping a solid holiday season that suggests consumer resilience heading into the new year. Separate data showed homebuilder sentiment climbed January by the most in nearly a year as lower mortgage rates boosted customer traffic, sales and the demand outlook.

To Andrew Hunter at Capital Economics, while a further slowdown possibly lies ahead, there is still little to suggest a sharper downturn is in store.

“A recession seems increasingly unlikely,” said David Russell at TradeStation. “Despite weathering an inflationary storm, consumers still have pent up demand and dollars to spend. A soft landing could be taking shape before our eyes.”

With consumer confidence gaining momentum, the economic landscape remains on solid ground — and the market reaction suggests hopes for a March rate cut becomes more elusive, according to Quincy Krosby at LPL Financial.

In fact, there’s a repeated refrain from the throngs of financiers in Davos this week: rein in your rate-cut expectations.

Everyone from JPMorgan Chase & Co.’s Daniel Pinto to Standard Chartered Plc’s Bill Winters to Cantor Fitzgerald’s Howard Lutnick have said they expect monetary policy to ease slower than anticipated by the market.

Still, traders continue to expect the Fed this year to embark on a reversal of the aggressive tightening campaign that lifted the cap on the federal funds rate to 5.5% in July 2023 from 0.25% at the start of 2022. But they look for the cuts to total about 140 basis points, down from a recent peak near 175 basis points.

Jason Draho at UBS Global Wealth Management says that it’s unlikely to be a smooth path for markets.

“Investors will be debating the type of soft landing, stage of the cycle, and the macro regime, and the wide dispersion of views now could quickly evolve based on new data,” Draho said. “That could lead to quick and dramatic market pivots to price in shifting consensus views.”

And as the earnings season continues, investors will need to consider their rate outlook alongside financial results, according to Jose Torres at Interactive Brokers.

“Robust pricing power and profitability are likely to lead to persistent inflationary pressures, which will incrementally delay rate cuts,” Torres said. “Weaker earnings trends, on the other hand, may lay the groundwork for monetary policy easing, but at the cost of deteriorating corporate fundamentals.