- GDP expands 4.5% in first quarter, fastest pace in a year

- Citigroup, SocGen upgrade full-year growth forecasts

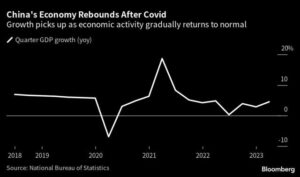

China’s economy grew at the fastest pace in a year in the first quarter, putting Beijing on track to meet its growth goal for the year without adding major stimulus, while also helping to cushion the global economy against a downturn.

Gross domestic product expanded 4.5% last quarter from a year earlier, official data showed Tuesday, beating economists’ expectations. In March, retail sales soared 10.6% from a year earlier, the biggest monthly gain since June 2021.

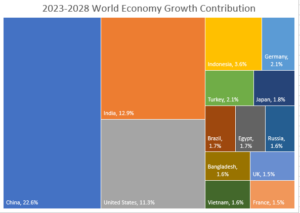

The upbeat data provide a foundation for China’s government to meet or exceed its GDP growth target of about 5% for the year. That would make China, alongside India, the largest contributers to global growth in 2023, accounting for about half of the expansion, according to the International Monetary Fund.

The strong GDP report prompted Citigroup Inc. and Societe Generale SA to upgrade their full-year growth forecasts for China to 6.1% and 6% respectively. S&P Global Ratings also said there’s upside risk to its current projection of 5.5%.

“That recovery of consumption should provide some comfort to policymakers and will probably nudge them a little further in the direction of not wanting to apply a significant amount of macro economic stimulus and starting to think about toning down the generosity of monetary policy,” said Louis Kuijs, S&P’s chief economist for Asia Pacific. “I think the growth momentum will be maintained.”

Growth in industrial output remains below pre-pandemic rates, while property investment continued to contract, even though housing sales have started to expand again. Weak real estate construction was to some extent offset by a surge in infrastructure investment led by state-owned companies.

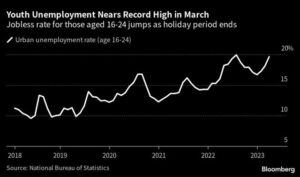

The jobs market and wage growth also haven’t returned to normal. Incomes of urban residents grew just 2.7% in inflation-adjusted terms during the first quarter from a year earlier, well below growth rates above 5% in pre-pandemic years. The youth unemployment rate climbed close to a record, while the nationwide urban jobless rate remained elevated.

Fu Linghui, a spokesman for the NBS, said Tuesday the economy’s rebound is “not yet solid.”

Financial markets were relatively muted after the GDP report. The benchmark CSI 300 Index of equities ended 0.3% higher for the day, while the offshore yuan rose 0.1%. China’s 10-year government bond yield slipped 1 basis point to 2.83%.

China remains crucial to the global economy this year as the US and Europe struggle due to factors such as high energy costs and consumer inflation running ahead of wage growth, which limits consumer spending. China will be the top contributor to global growth over the next five years, with its share set to be double that of the US, according to Bloomberg calculations based on IMF data.

March industrial output was buoyed by commodities production, with growth in cement output the strongest in two years, underlining higher demand from the construction sector. Vehicle production also climbed as car exports surged. The production of micro computer equipment fell 22% and integrated circuit output also slumped, adding to evidence of a broader slowdown in the electronic supply chain in East Asia that has hit South Korea’s exports.

The strong growth in retail sales suggest “there is no immediate need for fiscal stimulus to support consumers,” Iris Pang, chief Greater China economist at ING Group NV, said in a note. March’s growth of clothing sales, Pang’s favored measure of household consumption appetite, was the highest in nearly two years.

Other indicators released this month have provided conflicting signals about the recovery: credit and exports surged in March, but inflation remained weak. While the latter is generally a sign of muted domestic demand in the economy, economists at Goldman Sachs Group Inc. argue the weak inflation figures may indicate growth in demand is being outpaced by a recovery in supply.

Economists are divided about whether the government needs to roll out more stimulus to boost growth. People’s Bank of China Governor Yi Gang said last week the economy was on track to grow in line with the GDP target, suggesting there’s no need for major stimulus. The central bank on Monday refrained from cutting a key interest rate and curbed its cash injection into the banking system — although some analysts still see scope for easing in coming months.

“As the economy gains strength, there is no need for the PBOC to cut interest rates,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd. “All they need to do is to ensure sufficient liquidity in the money market.”