Two of Bank of America Corp.’s leading markets strategists struck a rare agreeable tone on Friday, each prophesying gains ahead for equities — at least in the near term.

Chief investment strategist Michael Hartnett broke from his usual bearish view to say technicals no longer stand in the way of a year-end rally for the S&P 500 Index. And Savita Subramanian, head of US equity and quantitative strategy and an optimist on stocks this year, said now was a better time to buy the US benchmark relative to its July peak, noting the frequency of clients asking whether they should wait longer for an entry point has increased.

“Extreme fear can be just as costly as greed,” Subramanian wrote Friday in a note to clients.

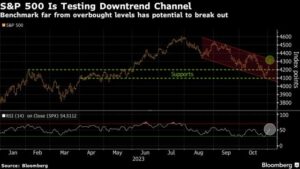

Earlier in the day, Hartnett said equity positioning could pick up in stocks, with oil under $100 a barrel, yields below 5% and the S&P 500 now trading above 4,200 points, seen as an important support level by traders. “But note, everyone now expects a big year-end rally,” he added.

While it is not unusual for strategists under the same roof to have diverging views, the contrast in perspectives between Hartnett and Subramanian this year has reflected the uncertainty about what’s ahead for equity markets in a higher-for-longer interest-rate environment.

Despite his technical view on a year-end rally, Hartnett has remained bearish throughout 2023, even as the S&P 500 rallied in the first half and is up more than 13% this year. Subramanian, on the other hand, was one of the first Wall Street prognosticators to flip to a bullish outlook in May as stocks gained, though just before a three-month slump.

After falling from July’s peak, the S&P 500 is now set for its best week in a year, lifted by an oil price retreat and hints from Federal Reserve Chair Jerome Powell that the US central bank may be finished with the most aggressive tightening cycle in four decades.

US stocks rallied Friday as data showed job growth moderated in October by more than expected and the unemployment rate rose to an almost two-year high, prompting traders to bring forward their expectations for the first Fed rate cut to June from July. That’s a sharp reversal in trend from last week, when the index briefly dipped below the key 4,200 level.

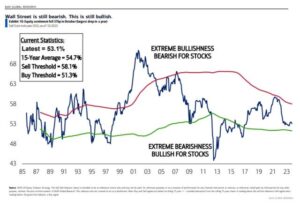

Bank of America’s in-house sentiment gauge, the Bull & Bear Indicator, is flashing a contrarian buy signal for a third straight week amid poor equity market breadth — a reference to the number of stocks rising — and large outflows from high-yield and emerging-market bonds, Hartnett wrote in his note. The indicator has slid to 1.4, below the 2 level that BofA says implies a buy signal.

BofA strategists earlier this week led by Subramanian said a contrarian indicator from the bank is also close to offering a buy signal, with its current level implying a 15.5% price return for the S&P 500 over the next 12 months.

Nonetheless, investors continued to pour money into safe-haven cash funds during the week through Nov. 1. Flows of more than $64 billion in the latest week took annualized inflows to $1.3 trillion, according to EPFR Global data cited by Hartnett. Equity funds had $3.4 billion pulled out while bonds enjoyed inflows for the fourth straight week, absorbing $4.5 billion.