The ISM non-manufacturing index confirmed that the economy is bouncing back fast, which supports risky assets, despite the worrying news on public health.

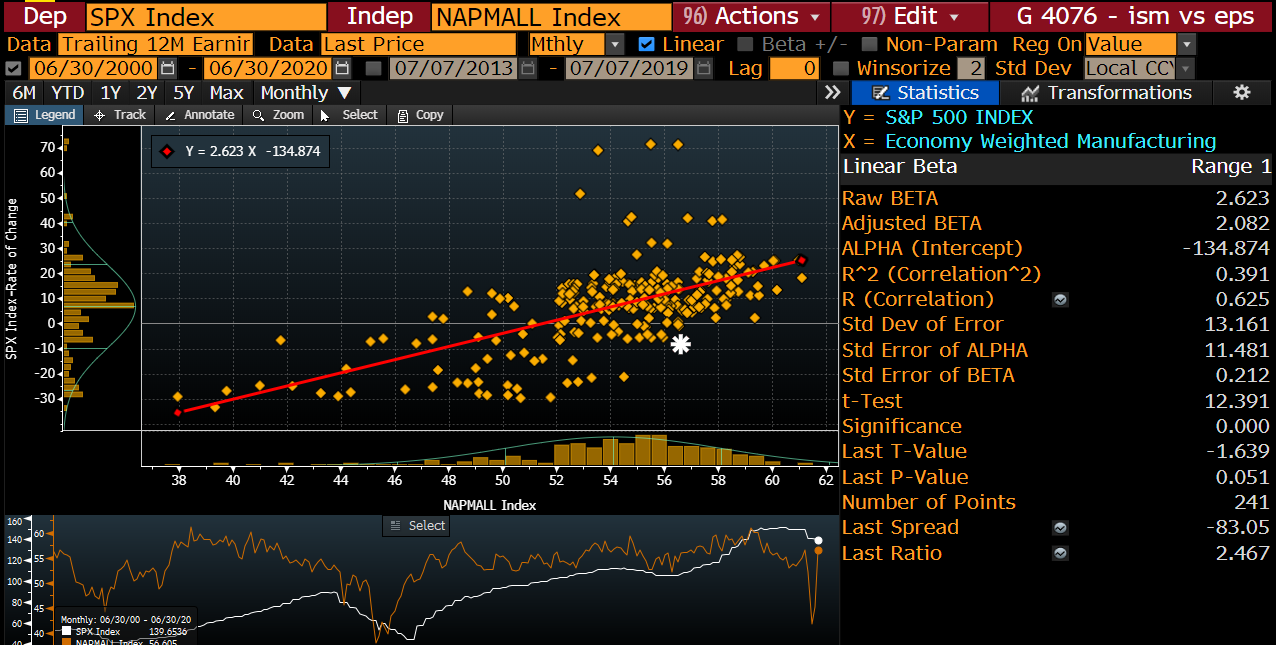

The 57.1 reading in the service index implies real GDP growth of 2.9%, according to the ISM. If we look at the historic relationship between the SPX 500’s earnings estimate and the weighted composite ISM manufacturing and service index, the reading of 56.6 in the index suggests EPS should be expanding 14% YoY. Currently, analysts expected a 2021 EPS of $162 per share, or an 8% increase from the 2019 level.

Now the caveat: The ISM survey is a diffusion index, tracking the difference between how many businesses see an expansion and those that see contraction. So the index perhaps tells us more about the direction of the economy, than the magnitude of the rebound. Moreover, the data may be a bit dated, given the fast spread of the virus and the retreat in the reopening process in recent weeks.