America Inc. Isn’t Worrying

(Bloomberg) —

Hello. Today we look at what the U.S. corporate-earnings season is telegraphing about recession risks, how China’s latest lockdowns may translate into some of the biggest global supply lockdowns yet and who got hit hardest in the pandemic job market.

Still Sanguine

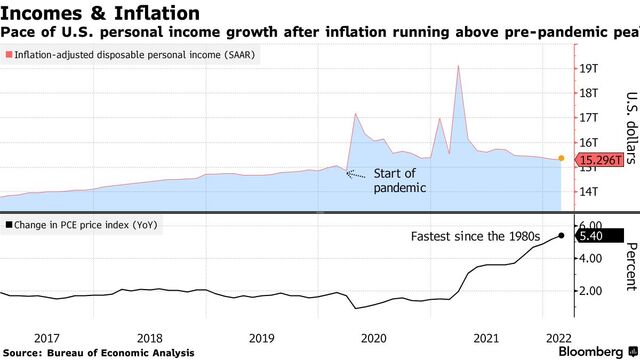

American chief executives aren’t yet subscribing to fears that red-hot inflation will ultimately tip the economy into recession.

Weeks after Wall Street banks kicked off earnings season by saying household finances were in good shape, Main Street firms are lining up to express confidence in the U.S. consumer even as price pressures mount, according to this storyfrom Olivia Rockeman, Reade Pickert and Vildana Hajric.

- Proctor & Gamble, which counts Tide, Bounty and Pampers among its brands, has seen no exodus from premium-brand products

- Credit-card giant American Express still sees solid travel demand

- L’Oreal sees “consumer purchasing behavior unaffected by inflation”

- Kimberly-Clark CEO Michael Hsu says the company’s price strategy is “very effective right now”

Overall, first-quarter earnings are beating estimates by 7%, with roughly 75% of S&P 500 firms topping projections, according to data compiled by Credit Suisse. Assuming the current beat rate, profits are on pace to grow 12% versus the same period last year.

“Any talk of recession at this point is premature,” Tractor Supply CEO Hal Lawton said April 21 — a point underscored by the calculation, by Bloomberg Economics, that there’s a zero chance the economy will contract this year.

For all the public angst about inflation, it seems for now that households are keeping on shopping.

And that’s critical for the economy given that consumer spending accounts for about two-thirds of gross domestic product.

Still, Netflix last week showed fallout is still possible and a survey this week revealed about 40% of U.S. small businesses intend to raise selling prices by 10% or more.

“Part of the inflation story is how the consumers handle it and are we going to see consumption get cut off, or will consumers just push through the higher prices and continue to consume?” said Chris Gaffney, president of world markets at TIAA Bank. “So far, it looks like consumers are shrugging off the price increases, but everybody is complaining about it.”