(Bloomberg Intelligence) — With a market accustomed to extreme EPS beats, the focus now turns more toward the recovery’s endurance. Analysts are more confident in the longer-term outlook, as a remarkable 1Q beat drives up growth forecasts, and the 2021 rebound is expected to morph into steady expansion into 2022. Not all is perfect: Long-range forecasts for value stocks may be getting stuck as growth views improve.

The extraordinary earnings beat unfolding in 1Q has been joined by larger-than-usual upward revisions to 2Q-4Q EPS expectations. Since the start of April, 1Q EPS forecasts have jumped nearly 18%, while 2Q is up 4.1%, 3Q 2.5% and 4Q 1.9%. In the four years prior to 2020’s Covid-19 crisis, the average adjustment to 2Q was down 2.1%, minus 0.9% in 3Q and negative 0.1% in 4Q. Sales forecasts rose 1.4%, 1.1% and 0.9% for the next three quarters, respectively.

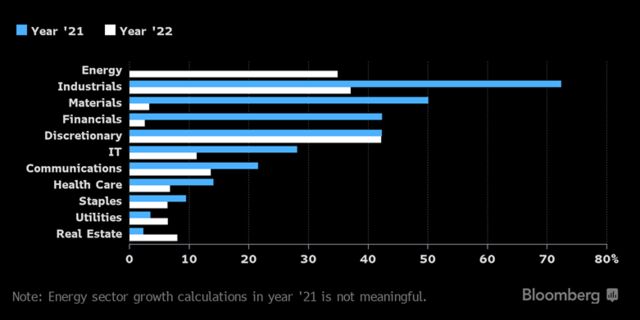

Estimates for 2Q EPS went up most for energy, materials and communication services, and rose for nine of the 11 sectors. Likewise, 2H EPS estimates climbed for eight of the S&P 500 sectors, led by IT and communication services.

Analysts have made notable upward adjustments to 2021 earnings expectations amid much stronger than anticipated 1Q earnings reports, and much of the recovery is expected to stretch into 2022. With 1Q EPS growth tracking to double forecasts, full-year 2021 estimates have risen 4.8% since the start of April, while 2022 EPS went up 2.9%. Every sector except utilities recorded an increase in its EPS forecast for each year. Financials led the charge on 2021 adjustments, while technology is ahead in 2022 revisions.

Sales-forecast revisions have likewise been positive, but slightly less broad, potentially showing where momentum may slow. Full-year 2021 sales estimates for consumer staples, health care and utilities dropped, while energy, real estate, materials and utilities declined for 2021.

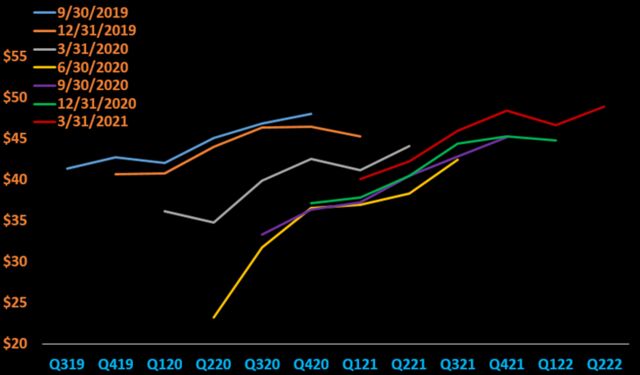

The market may be set up to react poorly to a more normalized earnings environment, as investors have gotten used to extreme beats of low expectations. Every quarter since 2Q20 has been extraordinary: On average, 84% of reporters topped forecasts over the past three quarters (including 1Q so far), well above the 10-year average of 71%, and the average EPS beat since 2Q20 was 10% more than the 10-year figure. The average increase in quarter-ahead estimates has been 3.4% for the past three reporting periods, vs. a five-year average of minus 2.7% prior to 2020.

By the time the low was reached in 2Q20, the six-quarter-ahead forecast implied EPS would fail to recover to peak before 3Q21, but in the end, the earnings stream fully recovered early 2020 losses by 4Q, three quarters ahead of schedule.

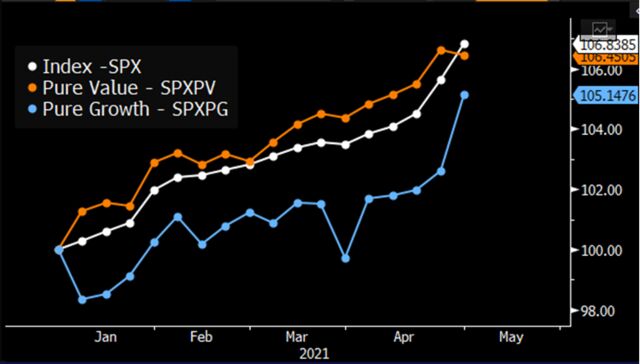

Value stocks’ surge relative to growth could come to a halt if the group can’t maintain carry momentum into 2022. Since the start of the year, S&P 500 pure value stocks’ 2022 EPS forecast has increased 6.5%, while views for their growth counterparts have increased 5.2%, both slightly short of the S&P 500 index’s 6.8%. Value estimates have moved up slightly faster than growth because the group is anticipated to expand margins: Revenue estimates for 2022 have fallen significantly for value, while the outlook for growth stocks has improved a touch.

Much stronger than expected EPS growth in 2021 appears to be depleting anticipated gains in 2022 more for the value segment as well, implying analysts remain skeptical that strong expansion can endure.

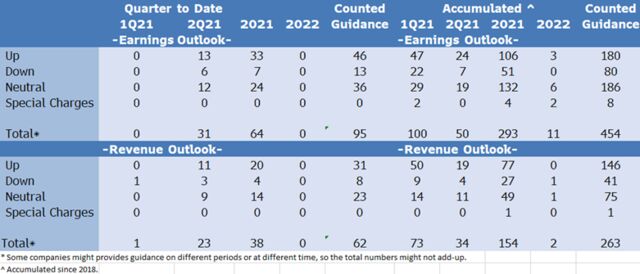

Companies have started to roll out 2Q guidance, with a positive skew on the top and bottom lines. In 1Q reports, 31 S&P 500 constituents released 2Q outlooks, with 13 above analysts’ forecast and six below. Of the 23 to provide top-line insight, 11 believe 2Q will be better than expected and just three guided down. Full-year guidance skews positive for sales and profit as well. Last week, 17 members raised revenue and EPS guidance and seven reduced 2Q views. Most companies anticipate 3% inflation, while a few project 4-5%.

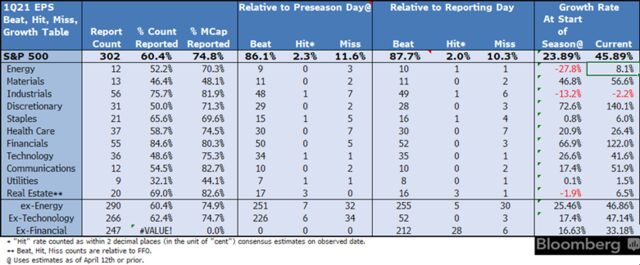

Three-quarters of the S&P 500’s market cap has reported 1Q results, tracking a 46% EPS increase vs. preseason growth expectations of 24%. Every sector is on pace to beat, led by financials and discretionary. An expected year-over-year decline for energy has turned into a gain. Only the industrials sector is projected to retreat vs. 1Q20, though far less dire than originally anticipated. Excluding energy, index EPS growth is on pace for an even stronger 46.9% advance (vs. 25.5%), and 366 of its 500 constituents are expected to expand — the strongest breadth since 4Q18.

Among companies that reported last week, Ford and Interpublic Group beat estimates by the most, while Boeing and Discovery had the biggest misses.

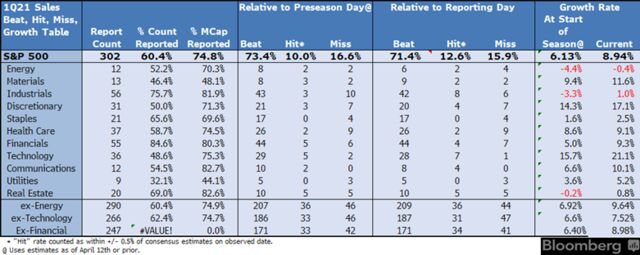

S&P 500 sales are on pace to increase 8.9% after the first three weeks of 1Q reporting, above forecasts of 6.1%, with four sectors on pace to double-digit growth — materials, discretionary, technology and communications. Excluding energy, the S&P 500 is in-line for 9.6% EPS expansion vs. 1Q20, the strongest since 2Q18. So far, 71.4% of reports topped revenue-growth estimates and less than 16% missed — the lowest in our records since 2009. No misses have occurred in the communications sector, and just one among tech constituents.

Last week, Cincinnati Financial and Xcel Energy breezed by sales forecasts, while Principal Financial and Newmont missed the most.