Reade Pickert and Olivia Rockerman

BloombergFebruary 4, 2023

- Early 2023 numbers on jobs, services show resilient consumers

- Businesses from GM to United Airlines point to strong demand

Don’t count the US consumer out just yet.

Two sets of data out Friday raised hopes that the pullback in household spending at the end of last year was just a blip. In the first month of 2023, Americans ramped up purchases of services — everything from restaurant meals to health care — while businesses went on a surprise hiring spree.

Those are encouraging findings at a time when many economists are worried about recession. Services account for the biggest chunk of household outlays, and jobs are the most important source of income to fund spending.

Taken together, the numbers suggest that US consumers likely aren’t throwing in the towel just yet. That may make life trickier for the Federal Reserve, as it seeks to rein in prices by curbing household demand. But it enhances the prospect of a so-called soft landing for the economy, a scenario where inflation cools down without a spike in unemployment.

Consumers are “certainly on better footing than we or anyone thought just a few days ago,” says Tim Quinlan, senior economist at Wells Fargo & Co. “If hiring remains strong, and inflation continues to go from high and rising to high and falling, then there’s an increasingly viable path toward a soft landing, where real consumer income is driving spending rather than a drawdown of saving.”

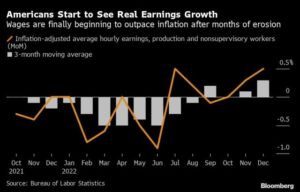

Wages Boost

For much of the last two years, Americans’ pay couldn’t keep up with the rising cost of staples like food, rent or gasoline. But with price increases now slowing down, workers are finally seeing their inflation-adjusted incomes start to rise.

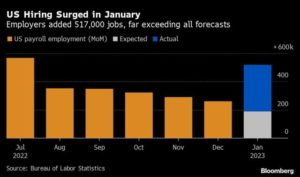

The strong labor market has bolstered wages – and it just got stronger. Hiring was expected to be slower in January. Instead, employers added more than half a million jobs, beating all estimates. Unemployment fell to the lowest since May 1969 – a time before astronauts had set foot on the moon.

Read more: US Payrolls Surge as Jobless Rate Hits 53-Year Low

A single month’s data can be an unreliable guide, and some economists point to seasonal quirks that made January’s numbers look better than the reality. Still, that report is only the latest indication of the labor market’s strength. Unemployment filings have fallen in four of the last five weeks. Job openings are back above 11 million, and more small businesses are saying they have positions they can’t fill.

Consumer spending declined in both November and December, partly because of weakness in services. But those outlays rebounded in January, with the Institute for Supply Management’s gauge of activity at service providers jumping by the most since mid-2020.

Businesses in all kinds of industries are picking up on the signs of consumer resilience.

General Motors Co. Chief Financial Officer Paul Jacobson said January was a “really, really strong” month for the automaker and “we still feel good about where demand sits.” United Airlines Holdings Inc. and American Airlines Group Inc. both said last month that they expect strong demand and profits in 2023.

Even companies that reported weaker-than-expected earnings or forecasts this week, including Starbucks Corp. and Estée Lauder Cos., said the trouble stemmed from weaker sales in China, which has been struggling with a Covid spike, rather than the US.

The technology sector is a notable outlier. In recent months, tech companies like Microsoft Corp. and Google’s parent Alphabet Inc. have cut thousands of jobs. Many have shelved investments and scaled back office space, after the flush years of the pandemic.

One distinction is that tech companies rely on corporations, not just consumers, for revenue in areas like advertising or cloud computing. Another reason they’re not benefiting as much as some industries could be because “the consumer is clearly using a greater portion of discretionary spending on experiences rather than goods,” says Angelo Zino, an analyst at CFRA Research.

There are still plenty of things that could derail consumer spending.

Pandemic inflation isn’t over, even if it’s easing, and about 40% of Americans said in January that it was somewhat or very difficult to pay for their usual household expenses, according to a Census Bureau survey.

The savings rate has fallen steeply from pandemic highs, and households are increasingly leaning on credit cards. Lower-income households, in particular, have shown signs of pulling back.

McDonald’s Corp. Chief Financial Officer Ian Borden cited evidence that customers are more cautious about what they’re ordering. The chief executive officer of jeans-maker Levi Strauss & Co. noted how lower- and lower-middle income consumers are having to make “really hard budget choices right now.”

What’s more, many Americans bought big-ticket items like furniture or appliances during the spending rebound that followed pandemic lockdowns – which means they likely won’t need to upgrade for a number of years.

For now though, with jobs abundant and services spending on the rise, there’s little in the latest set of numbers to suggest an economy on the brink of recession.

“The consumer has been really resilient throughout the course of 2022 and seems to be similarly resilient going into 2023,” says Neil Saunders, US-based analyst at research firm Globaldata Plc. It “doesn’t appear that there will be a consumer recession any time soon.”